Monetary Unit Sampling Bounds play a crucial role in auditing, offering auditors a statistical framework to assess financial data precisely. This blog post delves into the fundamentals of these bounds, explaining their importance, how they are calculated, and their impact on audit decision-making. By understanding the bounds of Monetary Unit Sampling, you can enhance the accuracy of your audits and make more informed decisions. Join us as we explore the key aspects of these bounds and their practical applications in auditing.

Understanding Monetary Unit Sampling

Monetary Unit Sampling (MUS) is a statistical sampling method used in auditing to select a sample for testing from a population where the selection probability of each unit is proportional to its monetary value. In more statistical terms, MUS is an application of Probability Proportional to Size (PPS), where each dollar acts as a sampling unit, and each transaction/item is a cluster.

However, when talking about MUS, auditors often refer to it as a sampling method to perform a substantive test. It contains a method to determine sample size, pick samples, calculate the sample’s result, and project the misstatement (if any).

As you may conclude from previous sentences, MUS is a statistical sampling method, ergo, we can conclude certain attributes of the population (e.g., whether the population’s misstatement is beyond a tolerable point) based on samples. When do we do that? It’s when we project the sample’s misstatement to the population.

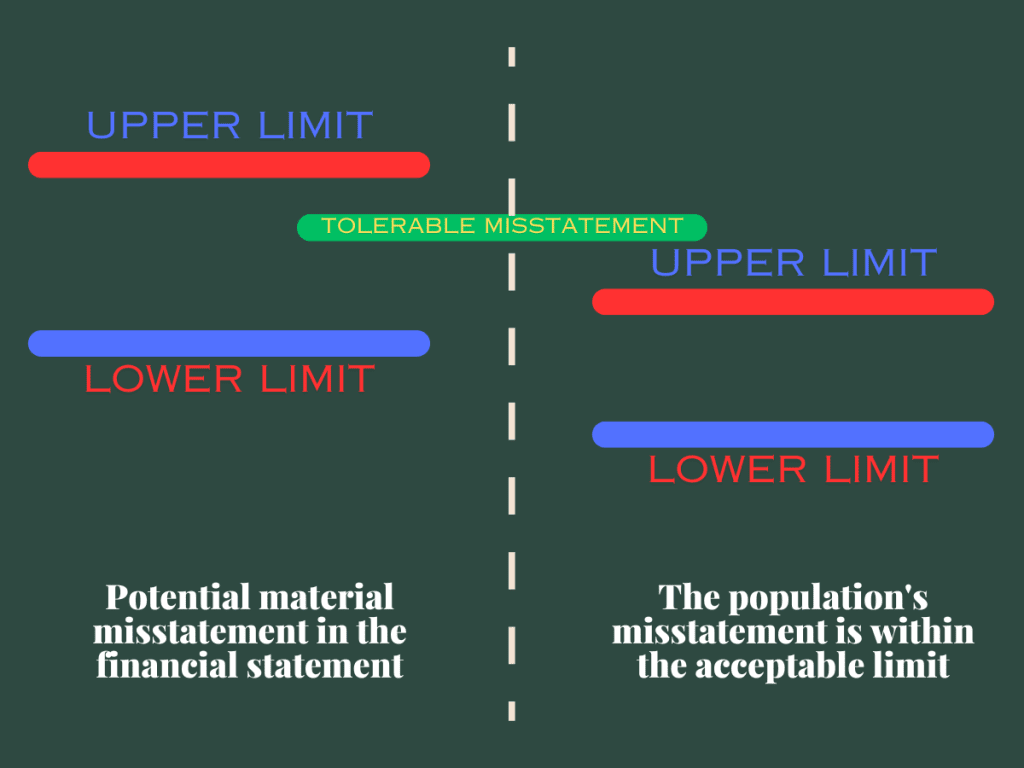

Because we use statistical methods, we must be aware that when projecting the sample’s misstatement to the population, there is always a possibility that the conclusion isn’t 100% accurate. The conclusion is always an estimation between two values (lower limit and upper limit). That’s the Monetary Unit Sampling’s Bound.

The Concept of Bounds in Monetary Unit Sampling

In monetary unit sampling, a “bound” often refers to the calculated upper limit on the total projected misstatements of a population based on the findings within the sample audited. Bound is like the “confidence interval” but applies to the projected misstatement. This bound considers the possibility of sampling risk — the risk that the sample is not representative of the population.

The upper bound on misstatements is a conservative estimate that auditors use to determine if the account balance’s population is materially misstated. It is calculated based on the specific methodology of MUS, incorporating factors such as the sample size, the population’s total value, the misstatements identified within the sample, and the desired confidence level (e.g., 95%).

If the bound has two values, lower and upper bound, why do we care only about the latter (at least for most of the time)?

Because we use the bound by comparing it to the tolerable misstatement. If the upper bound is below the tolerable misstatement, thus the lower bound is below the threshold’s value.

Practical Applications of Monetary Unit Sampling Bounds

It may seem obvious, but there are several practical applications of MUS bound. Here are some of those.

- Assessing materiality of misstatement. As previously discussed, the MUS bound helps auditors determine whether the total projected misstatements in a financial account or transaction class are material. This assessment influences our opinion on the financial statements.

- Guiding audit decisions. Continuing the previous pointer, calculating MUS bound (or upper error limit) provides a quantitative basis for making informed audit decisions. For example, if the UEL is within acceptable limits, the auditor may conclude that further testing is unnecessary. Conversely, if the UEL exceeds tolerable limits, it may indicate the need for additional audit procedures, such as expanding the sample size or performing alternative substantive tests.

- Communicating with management. Auditors use the results from MUS, including the bound calculations, to discuss misstatements with management. This dialogue often involves understanding the causes of misstatements and agreeing on adjustments to correct identified errors or irregularities.

- Informing audit opinions. Finally, applying MUS and interpreting the bounds calculated to contribute to the auditor’s formulation of an opinion on the financial statements. Whether issuing an unmodified opinion or identifying a need for a qualification, disclaimer, or adverse opinion, the MUS bound plays a critical role in this decision-making process.

MUS Bounds and Audit Decision-Making

Suppose the upper bound of projected misstatement is below the materiality threshold for the audit. In that case, the auditor may conclude with a certain level of assurance that the financial statements do not contain material misstatements in the context of the audited account or transaction population. If the bound exceeds the materiality level, further investigation or an expanded audit scope may be necessary to gain reasonable assurance about the financial statements’ accuracy.

After that, the results may guide you to the opinions you need to communicate to the management.

Challenges in Applying Monetary Unit Sampling Bounds

When using MUS, there are several challenges specific to MUS bound.

- Complexity in Calculation. The upper confidence bound in MUS can be complex, requiring a solid understanding of statistical principles and often using specialized software. This complexity can be a hurdle for auditors less experienced with statistical methods.

- Assumption of Misstatement Distribution. MUS assumes a certain distribution of misstatements across the population. If this assumption does not hold (such as when misstatements are not proportionally distributed), the accuracy of the bound calculation may be impacted.

- Choosing the right bounding approach. Several approaches exist, such as Moment bounds, Adjusted Empirical likelihood bounds, and Bayesian Bounds. Choosing which is a better fit for the audit assignment can be challenging (or confusing).

- Determining Tolerable Misstatement. Setting an appropriate level for tolerable misstatement, which significantly affects the bounds calculation, can be challenging. It requires professional judgment and understanding of the entity’s financial and operational context.

- Risk of over-reliance. There’s a risk that auditors may place too much confidence in the bounds generated by MUS without considering qualitative factors. This over-reliance can lead to insufficient scrutiny of areas not highlighted by the sampling.

- Interpreting Results. Understanding what the bounds mean in the context of the audit and explaining these implications clearly to non-auditors, such as management or audit committees, can be challenging. It requires statistical knowledge and the ability to communicate complex concepts.

Conclusion

In wrapping up our exploration of Monetary Unit Sampling Bounds, it’s clear that these bounds are more than just statistical outputs; they are essential tools that auditors rely on to assess the financial integrity of a population. The ability to calculate and interpret these bounds accurately empowers auditors to make informed judgments, ultimately contributing to the reliability of financial statements. Despite the challenges, such as the complexity of calculations and the need for a deep understanding of statistical principles, the benefits of applying MUS bounds in audit work are undeniable. They provide a quantifiable measure of audit risk and help auditors pinpoint areas requiring further attention.

For more insights into audit techniques and to keep up with the latest trends in the field, consider subscribing to our newsletter. Join our community of professionals committed to excellence in auditing and take your expertise to the next level. Share your experiences or questions about Monetary Unit Sampling Bounds in the comments below. Let’s foster a discussion that enhances our collective understanding and application of this crucial audit tool

Images generated by DALL-E3.