Sieve Sampling Audit is one of the Monetary Unit Sampling (MUS) sample selection methods. Although it’s not popular and isn’t endorsed by well-known sources like AICPA’s Audit Guide, it’s a solid method with some advantages to auditor’s benefits. There are also challenges and considerations before using it. Ready to impress your partners with your innovative thinking? Let’s explore this powerful sampling method that can streamline your audits while the results still give you confidence.

We can employ several methods when selecting a sample in Monetary Unit Sampling. To name a few, the systematic selection method endorsed by the AICPA’s Audit Guide: Audit Sampling and Whittington. Conversely, Arens in Auditing: The Art and Science of Assurance engagements use simple random selection when explaining sample selection in MUS.

However, when you type Monetary Unit Sampling in Google Scholar, you’ll get several studies about sampling selection. Among these, Sieve Sampling emerges as a particularly notable method.

What is a Sieve Sampling Audit?

Sieve sampling is a sample selection method without replacing line items (or transaction, or logical unit, in AICPA’s Audit Guide term), ensuring each item is chosen only once. Like cell sampling, it calculates the sampling interval by dividing the total population by the sample size. For every line item, an independent random number is picked within the sampling interval, selecting the item if the random number falls within its book value. The method leverages the inherent structure of the population, enabling the precise selection of unique monetary units across various line items.

Introduced by C. Rietveld, an innovative auditor from the Netherlands, in 1978, Sieve Sampling came into play with its practicality and flexibility. This method streamlines the process by eliminating the need to sort random numbers and tally up book values to pinpoint sampled line items. Rietveld compared this technique to sifting through items with a sieve of arbitrary mesh size, simplifying the selection process.

Often, it’s better to learn how to perform a method to gain a better understanding of it. Let’s talk about Sieve Sampling’s practical application.

Implementing Sieve Sampling in Audit Processes

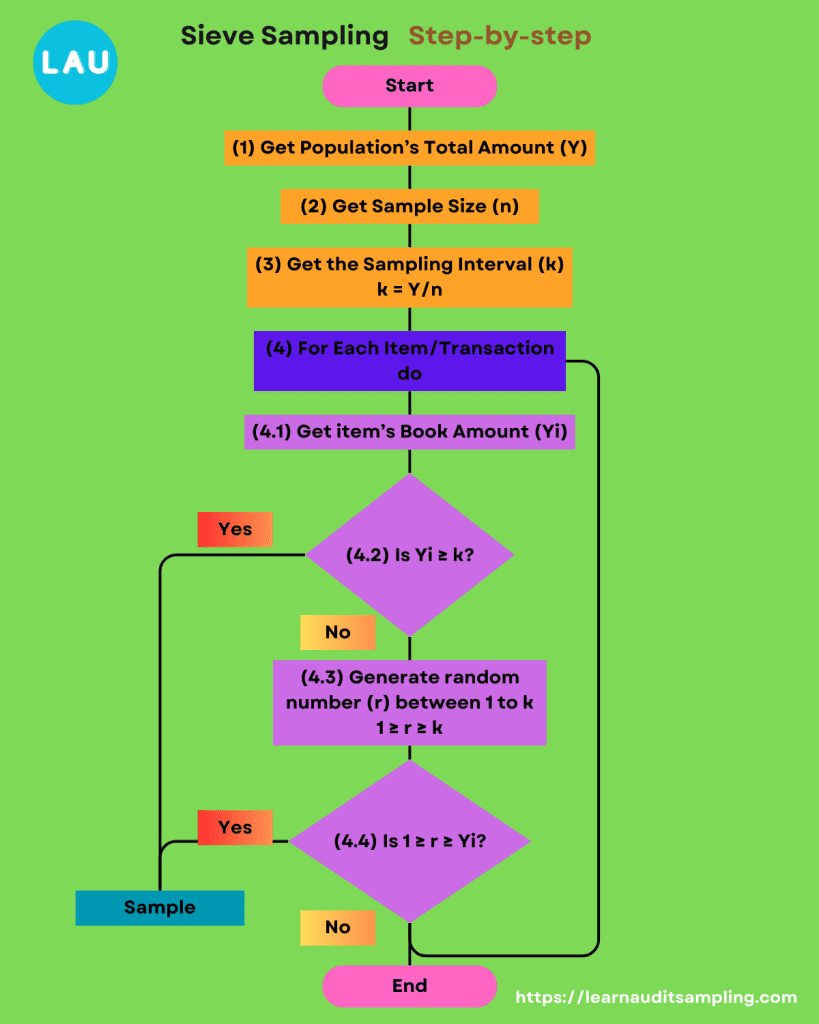

The previous image sums up how we use Sieve Sampling in audit. First, get the sampling interval by dividing the population’s total amount by the planned sample size. We’ll use the sampling interval as an upper limit when generating a random number for each item/transaction.

Yes, we generate a random number between 1 and the sampling interval for each item. If the random number falls less than or equal to the item’s book value, we move the item to the sampling bucket. Following this logic, it becomes clear that items with a book value exceeding the sampling interval are invariably selected as part of the sample.

Another thing that will naturally pop up in your mind is the actual sample size could be less or greater than the planned one. Such a situation can be an advantage and disadvantage of the method.

The Benefits of Sieve Sampling in Auditing

- It doesn’t require sorting of logical units (transaction/item)

- There is no need to obtain cumulative subtotals, simplifying the sampling process.

- Statistical Efficiency: Analysis has shown that sieve sampling can be more statistically efficient than other sampling methods in specific scenarios, particularly in large line item populations when the sample size is not small.

- Precision: Sieve sampling is more precise than unrestricted random sampling in many cases, providing tighter estimation bounds for the total error amount.

Challenges and Considerations

The major challenge is the sample size produced from Sieve Sampling’s procedure may vary. The sample size can be greater than the planned sample size, or it can be less.

- Loss of Control: The auditor may have concerns about losing control over fieldwork due to the unpredictable sample size, which can lead to challenges in budget management.

- Uncertain Predictability: At the planning stage, the sample size can only be predicted within certain probable limits, making it difficult to estimate the resources needed for the audit accurately.

- Lack of Precision: The variability in the sample size may result in less precision in the audit process, as the actual number of line items audited may differ from the target.

Stabilized sieve sampling is a modification that overcomes the variable sample size problem by returning a constant sample size of monetary units, thus making it a reliable MUS method.

Sieve Sampling Audit vs. Other Sampling Methods

Below are the differences between Sieve Sampling and other sampling selection methods (such as simple random sampling, Cell sampling, and Lahiri sampling).

- Exploits natural population structure: Sieve sampling takes advantage of the natural structure of the population, avoiding the need to form cumulative subtotals and trace selected monetary units to their associated line items.

- Distinct line item selection: It returns a sample of different line items, providing a clear view of the selected items.

- Convenience in implementation: Sieve sampling is convenient because it uses the line item structure of the population when selecting the sample, thus avoiding the need to obtain cumulative subtotals.

- Precision: Sieve sampling is more precise than unrestricted random and Lahiri sampling, making it a favorable option when precision is a key consideration.

- Flexibility: It offers flexibility in sample size; though the achieved sample size may be variable, it can be predicted within certain probable limits.

- Reduction in variability: Sieve sampling can decrease variability compared to other methods, contributing to more reliable results.

Yet, a notable drawback of sieve sampling, as opposed to other techniques, lies in its variable sample size – it could be more or less than initially planned. Such unpredictability might compromise fieldwork management, risk budget overruns, and potentially undermine the audit’s credibility should there be a significant deviation from the intended sample size.

Another point of caution with sieve sampling is its tendency to select fewer sample sizes, which could affect the overall representativeness of the sample.

Although sieve sampling is praised for its ability to pick unique line items, this fluctuation in sample size introduces real-world challenges for auditors in terms of planning and oversight.

Conclusion

As we’ve explored, Sieve Sampling Audit is a unique sample selection method that adds more options to the audit landscape. Understanding and implementing the method can benefit your audit process. It provides a less headache sample selection process. But at the same time, you must consider its natural challenges to maximize its potential.

Stay ahead in the auditing field. Join our newsletter for the latest insights and updates on innovative audit techniques like Sieve Sampling Audit. Subscribe now and never miss out on cutting-edge audit strategies that can transform your approach.

Image Generated by Google Gemini.