Tolerable misstatement in Monetary Unit Sampling is a key factor influencing audits’ accuracy and effectiveness. This blog post will explore how auditors set and use tolerable misstatement thresholds to ensure financial statements are free from significant errors. We’ll cover the basics of determining these thresholds, their impact on audit strategy, and practical tips for applying them in your audit processes. Understanding this concept helps auditors maintain the quality and reliability of their financial assessments.

Understanding Tolerable Misstatement in Monetary Unit Sampling

Tolerable misstatement is the maximum misstatement in an account balance you will accept without modifying your opinion.

As you might think, the financial statement may have misstatement(s) like anything else. That’s natural and okay if the misstatement doesn’t exceed a specific limit. Because anybody whose decision depends on the financial statement tends to make an error if the financial statement contains material errors, you, as the auditor, must ensure the financial statement is free from material misstatement.

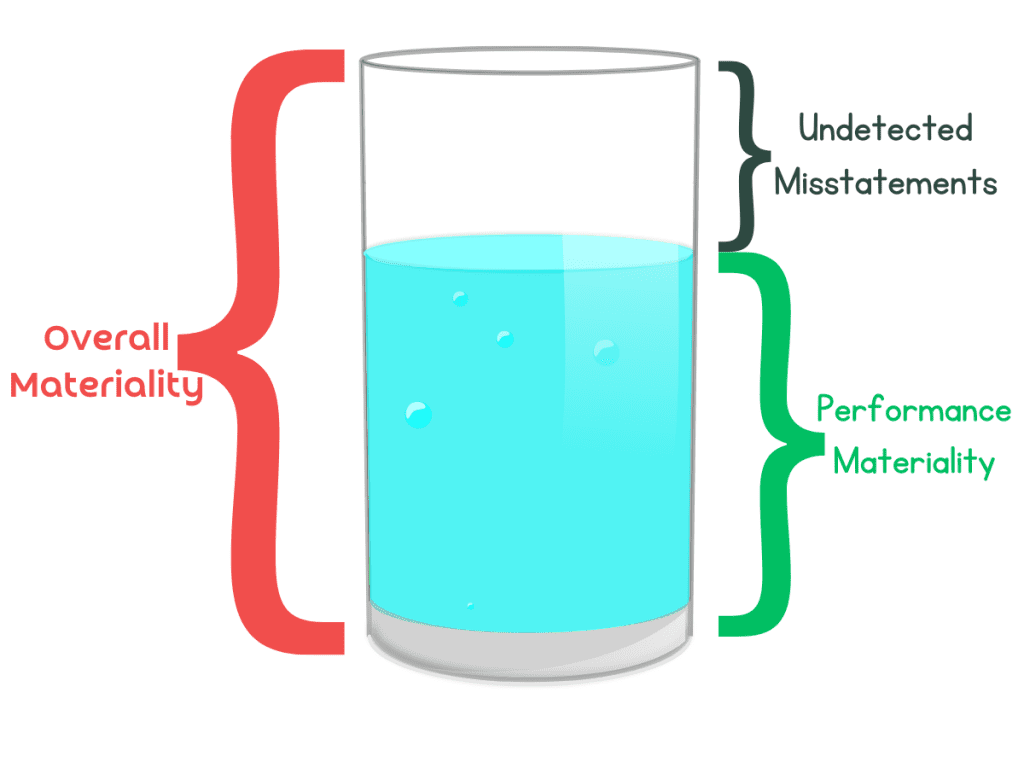

The auditors use overall materiality stuff to evaluate the whole financial statement. The logic is simple, if the misstatements found on the audit exceed the overall materiality, you shouldn’t tell the financial statement readers that it’s free from material misstatements.

However, every audit has its challenges. The lack of resources is also one of the audit challenges. Thus if you want to gather as many misstatements as possible, you need to focus on a small area (or account balance/transactions) which is (are) the biggest misstatement contributor(s).

The next question is, how do you know which area is (are) the best area to spend your time (and resources) with?

Introducing performance materiality, which, in short, is a tool to help your audit perform better. It is set as a percentage of overall materiality and is generally recommended to be between 50% (for a high-risk environment) and 75% (for a low-risk environment). Performance materiality is a guide to the level of work. Higher performance materiality reduces the scope of work needed. Conversely, lower materiality needs greater audit work. (Arens, Gray)

Now, let me introduce tolerable misstatement, the application of performance materiality at the account or class of transactions level. Suppose you were set the performance materiality to $750.000. You then allocate tolerable misstatements as follows:

- Cash: $50,000

- Accounts Receivable: $200,000

- Inventory: $300,000

- Property, Plant, and Equipment: $200,000

The sum of tolerable misstatements ($750,000) equals the performance materiality because your summaries of tolerable misstatements could only be less than or equal to performance materiality.

What’s the point of using tolerable misstatement? It’s the same as using overall materiality to determine whether the account is “okay.” If the total misstatement found in the account balance is below the tolerable misstatement, the account is ok, and vice versa. In other words, we may say that tolerable misstatement is the maximum misstatement the account balance (class of transactions) could have.

Now you might wonder why we always set the performance materiality below the overall materiality and then set the (summaries of) tolerable misstatements below the performance materiality. It’s because there is (are) always undetected misstatement(s) exists. Thus you should set those numbers below the “parent” number.

If you prefer the formal definition of tolerable misstatement is. Here it is.

Tolerable misstatement: A monetary amount set by the auditor in respect of which the auditor seeks to obtain an appropriate level of assurance that the monetary amount set by the auditor is not exceeded by the actual misstatement in the population.

AU-C Section 530 par .05

The Impact of Tolerable Misstatement in Monetary Unit Sampling

Tolerable misstatement plays a crucial role in MUS, such as determining the sample size or evaluating the audit procedure results. Here is the “complete” list of tolerable misstatement impacts in MUS.

- Sample Size Determination: Tolerable misstatement directly affects the sample size calculation in MUS. A lower tolerable misstatement generally means a larger sample size is needed to ensure the financial statements are free of material misstatements. This is because you are willing to accept a smaller maximum error in the account balances or transaction classes, necessitating more precise verification through a larger sample.

- Selection of Sampling Units: In MUS, each dollar in a population has an equal chance of being selected, making larger dollar items more likely to be picked. The tolerable misstatement influences the assessment of individual item misstatements in the sample. Smaller, tolerable misstatements often lead auditors to scrutinize larger value items more closely, as these could significantly impact the perceived reliability of financial reporting.

- Misstatement Evaluation: When you identify misstatements in a sample, you then project these findings to the population as a whole. Tolerable misstatement affects how these projections are made and evaluated. If projected misstatement exceeds the tolerable misstatement, you may conclude that there is a significant risk of material misstatement, leading to additional auditing actions such as expanding the sample or performing alternative auditing procedures.

- Decision Making: The tolerable misstatement guides the auditor’s decision-making process. It helps determine the population’s acceptability based on the sample results. If the projected misstatement is within the tolerable limit, the auditor may accept the population; otherwise, further actions are required.

Calculating Tolerable Misstatement in Monetary Unit Sampling

And how about determining the “right” tolerable misstatement? There are no “right” or “wrong” when deciding the tolerable misstatement. Oftentimes audit engagement has too many moving parts, thus making the tolerable misstatement determination always challenging. But here are some factors you could consider when calculating tolerable misstatement, especially when Monetary Unit Sampling is used.

1. Determine Overall Materiality: The first step in calculating tolerable misstatement for MUS is establishing the financial statements’ overall materiality. This is generally based on a percentage of a financial benchmark relevant to the entity being audited, such as total assets, total revenue, or net income. The choice of benchmark depends on the primary user interests and the nature of the entity’s business.

2. Set Performance Materiality (Tolerable Misstatement): Performance materiality, often synonymous with tolerable misstatement in this context, is set at a level lower than overall materiality to reduce the risk that the sum of undetected misstatements and other misstatements could exceed materiality. Typically, tolerable misstatement is set at 50% to 75% of overall materiality, depending on your assessment of the inherent and control risks associated with the financial statement accounts.

3. Consider the Audit Risk: The audit risk (the risk that you may unknowingly fail to appropriately modify your opinion on materially misstated financial statements) also plays a crucial role in setting tolerable misstatements. Higher perceived risks may lead to a lower tolerable misstatement, increasing the likelihood of detecting significant errors.

4. Use of Professional Judgment: You must use professional judgment to adjust tolerable misstatements based on qualitative factors such as the complexity of transactions, the extent of estimation involved in account balances, historical error rates, and the significance of certain accounts to stakeholders.

Calculating tolerable misstatements requires balancing quantitative factors (like financial metrics) and qualitative considerations (such as the auditee’s business environment and account complexity). This balance is critical to setting an appropriate scope for the audit procedures in MUS and ensuring that the audit provides a reliable basis for the auditor’s opinion on the financial statements.

Conclusion

Tolerable misstatement in Monetary Unit Sampling is critical in shaping audit strategies and ensuring financial accuracy. It helps you define the scope of your audit and focus on significant areas of potential misstatement. Properly setting this threshold is essential for conducting efficient and effective audits.

By carefully managing tolerable misstatements, you can provide more reliable audit conclusions and enhance stakeholder confidence in financial reports. This approach minimizes the risk of overlooking material errors and optimizes audit resources, making the process more effective.

Elevate your auditing expertise by staying updated with the latest methodologies. Subscribe to our newsletter for more insights and tips directly to your inbox. Join our community of professionals striving for excellence in auditing. Subscribe now and never miss out on crucial updates.