Misstatements (is always) occur, and it’s your duty as the auditor to find them. There are two kinds of misstatement, overstatement and understatement. Monetary Unit Sampling (MUS) is popular for its ability to handle overstatements. But how about the other misstatement, the understatement? Could MUS detect it? If it can’t handle such a situation, how about the alternative, is there any?

What is Monetary Unit Sampling?

When doing audit sampling, you’ll choose between two broad categories: statistical and nonstatistical, as Arens says. If you prefer the statistical method, especially on the substantive test, you could use Monetary Unit Sampling and classical variables sampling. Both methods, statistical and nonstatistical sampling, are valid, but the former offers some benefits, such as:

- Probability theory is used to determine sample size, and random selection methods ensure that each item in the population has an equal chance of selection.

- Reduces audit costs by optimizing sample size based on statistical principles.

- Statistical sampling involves random sample selection, reducing auditor bias in sample selection.

- Enhances the quality of audit evidence by providing a systematic and quantifiable approach to sample selection and evaluation.

- Statistical sampling enables extrapolation of the entire population from the sample.

Monetary Unit Sampling (or sometimes people use Dollar Unit Sampling) was specially developed for auditing in the 1960s. Because it was developed for audit, it outperforms other statistical sampling in some areas.

- MUS has gained wide acceptance in the auditing profession.

- It increases the likelihood of selecting high-dollar items from the audited population, which is crucial for identifying material misstatements.

- MUS often results in smaller sample sizes compared to classical variables sampling.

- Stratification to reduce variability is unnecessary in MUS.

So, what is MUS? You could consider it a statistical sampling method for audit. Usually, my “credibility” with my peers instantly increases when using sophisticated words like “statistics.” But how does MUS work? You probably need to elaborate a little about the method to defend your “credibility.” 😀

How MUS Works?

Monetary Unit Sampling treats each $1 (or any other currency) as a sampling unit. Interestingly, you rarely deal with a single dollar in the audit. In an audit, the auditor faces transactions with values of $5, $10, $1000, or any number other than a dollar.

So why is MUS relevant to the audit realm? Because that feature (treating each dollar as a sampling unit) makes the method interesting for the auditor.

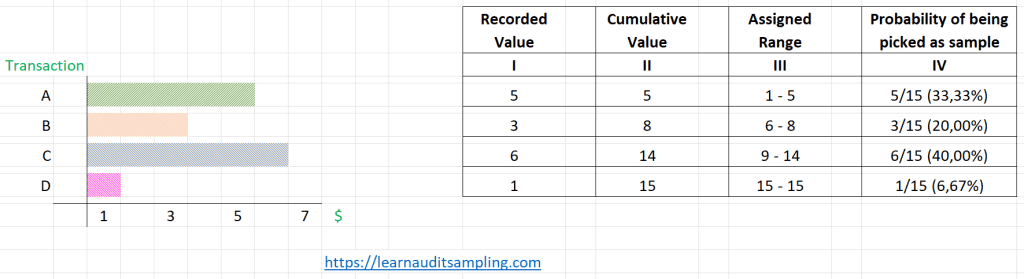

Consider there are four transactions you need to audit. Each has a recorded value (column I). Imagine adding a cumulative column (column II) and then adding the third column, which holds the assigned range number for each transaction (column III).

Now you have $15 in the account balance’s total, which means 15 sampling units (remember, in MUS, $1 is a sampling unit).

Continuing the example, you need to randomly pull 2 samples from the population of $15. The easiest and simplest method is to generate two random numbers between 1 and 15 (you can use MS Excel for the task).

Say you get numbers 5 and 11. Based on column III, you know transaction A holds number 5, and transaction C holds number 11. So, you pick transaction A and transaction C as samples.

Naturally, you now realize that the bigger the recoded value, the bigger the probability of being picked as a sample. As shown in column IV.

For example, transaction A will be chosen twice if the number generator produces numbers 3 and 5. Or, in the extreme scenario, say you need to pull five samples, and somehow the random generator’s output is 1, 2, 3, 4, and 5. Thus, transaction A has five probabilities as a sample because it has a recorded value of $5.

As you can see from the last case study, the probability of each transaction increased by its size. That’s why MUS is also known as an application of Probability Proportional to Size (PPS).

The previous example might be too oversimplistic. Practically, when performing MUS, you’ll follow these steps.

- Define the sample size

- Pick the samples

- Evaluate the sample’s result

- Extrapolate the sample’s result to the population

- Communicate the results to the auditee

- Formulate your audit conclusion based on the previous step.

What is Understatement?

Understatement happens when assets or liabilities that should be recorded and disclosed are left out. Assertion of Completeness ensures every asset and liability is accurately recorded and disclosed, leaving no room for understatement.

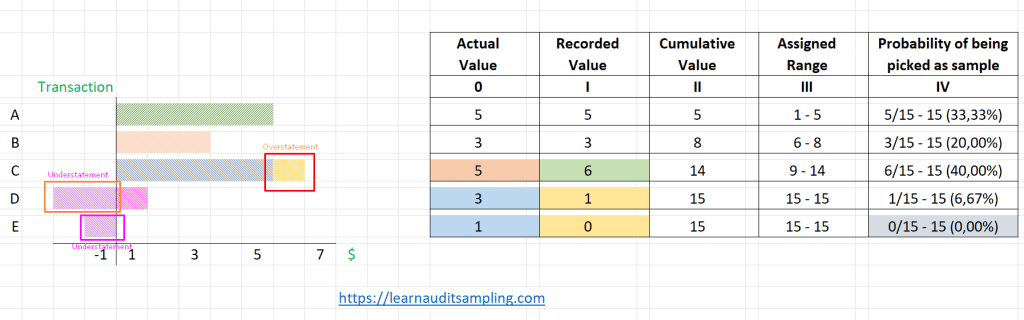

Using previous data, let’s visualize the understatement (and overstatement). This time, we’ll add one more transaction.

Ideally, both the actual value (column 0) and recorded value (column I) hold the same value. But after doing your audit procedure, you know that sometimes the recorded value is lower than the actual value. For this phenomenon, we use the term “understatement“.

Conversely, when you find the recorded value is greater than the actual value, you’ll call it an “overstatement.” Both understatement and overstatement are misstatements you need to “find” using your audit procedure.

For the last image, transactions D and E are understated, and transaction C is overstated.

Could Monetary Unit Sampling Detect Understatement?

TL;DR No, because the MUS mechanism, the one we elaborate on in the previous section, couldn’t “see” the “desired” transaction(s). But to some extent, it could catch the (transactions with) understatement.

If you refer to some sources such as AICPA Audit Guide: Audit Sampling, Prat, and Gray, you’ll see they say that MUS isn’t the best fit to test for the understatement. Let’s prove the statement using our humble data.

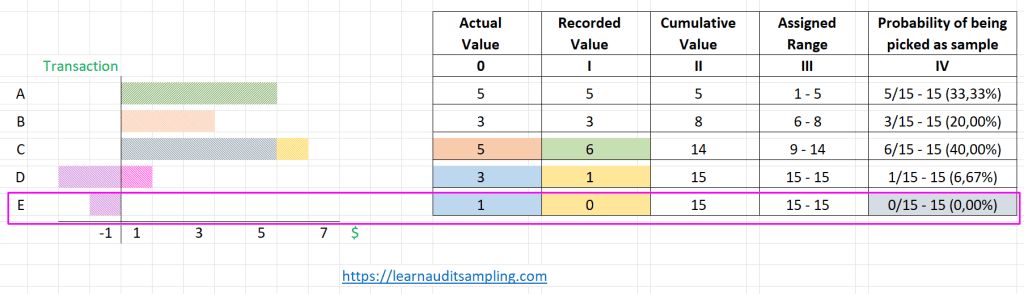

For the extreme case, transaction E, the actual value is $1, but it wasn’t recorded. Since the transaction has no recorded value and isn’t included in the account balances, there is no way MUS could “see” it and pick it as a sample. In other words, the possibility of being selected as a sample is zero, as shown in column IV.

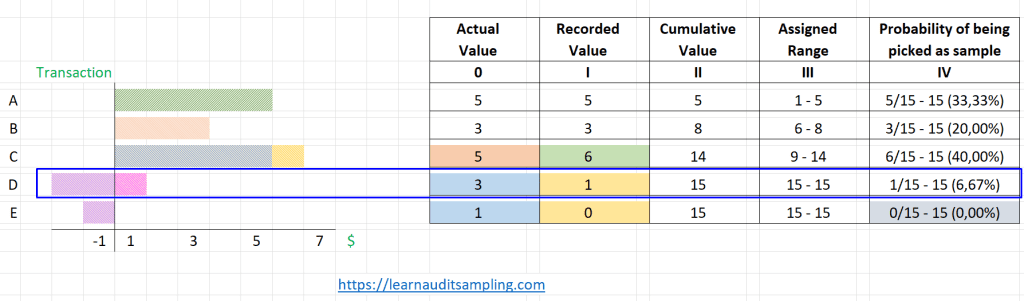

Monetary Unit Sampling treats each recorded dollar as a sampling unit. The feature prevents it from detecting understatements in transaction E, which isn’t included in the financial statement. How about transaction D, which is also understated, but at least there is a value ($1) being recorded?

There are probabilities (6.67% chance) to select transaction D as a sample. But compared to its probabilities, if the actual value is properly recorded (3/17 or 17.65% chance), the current probabilities (1/15 or 6.67%) are smaller. Thus, even if there are possibilities of the understatement transaction being picked due to its size, it’s quite unlikely to select it.

The Alternatives?

Ok, MUS might not be the best fit for detecting understatement. But how do you handle situations when you expect understatement in the population? What’s the alternative for such a scenario?

AICPA’s guide gives us a hint.

When the expected understatements might be significant in number or large understatement taintings are expected, a classical variables approach may be more appropriate.

AICPA Audit Guide: Audit Sampling

Furthermore, the AICPA’s guide elaborates on three classical variables sampling methods.

- The mean-per-unit approach

- Difference approach

- Ratio approach

Because those are not what we’re covering today, I highly recommend you give the AICPA Audit Sampling stuff. It’s worth reading.

For another alternative, don’t forget about the non-statistical sampling method; it’s valid. Also, it might be easier (or more familiar) for us.

Remember that each method has its own procedure, which you need to respect to ensure it’ll work as it should.

Conclusion

Monetary Unit Sampling is a powerful tool to perform your audit. It’s statistical-based, boosting your confidence in making conclusions in the assignment. It’s relatively easy to operate and interpret.

But MUS also has its limitations. Detecting understatement is one of them. Yes, MUS can still detect understatement, but with extensive notes. Even so, basically, the method is not the best fit for handling the scenario.

This led us to find another method: classical variables sampling, or non-statistical sampling approach. Just, don’t forget about each method’s “term and condition” to make sure you gather sufficient evidence about related account balances.

Stay updated on the latest auditing techniques. Join our newsletter for insights and tips on enhancing your audit processes. Don’t miss out on valuable information—subscribe now!