Another cool way to say Monetary Unit Sampling (MUS) is what you need when you repeat yourself many times. When you say the same thing over and over again, you’ll likely be bored with the term. And maybe your audience too. That’s why you want more intriguing words. No worries. There are a couple of alternative terms based on MUS’s definition, attribute, and mechanism. We’ll cover those alternatives and give a little explanation. Let’s dive in.

A Statistical Sampling

“We employ a statistical sampling technique to ensure our audit covers all significant transactions effectively.” That’s a classic one because almost everyone who has read an auditing book or other authoritative source knows that there are two methods of audit sampling: statistical sampling and non-statistical sampling. Statistical sampling is divided into attribute and variable sampling, which will be elaborated on in a minute.

Technically MUS falls into those two categories, attribute, and variable sampling, with some notes. To which is our next topic.

An Attribute Sampling but expressed as Variable Sampling

First, we need to know what attribute sampling and variable sampling are.

Attribute Sampling

Attribute sampling involves testing the presence or absence of a certain attribute in a population. This method counts how many individuals (or sampling units in another term) have the attribute.

For example, you want to test all purchase orders to find out whether those were properly authorized or not. So, the attribute you want to test is “properly authorized.”

After the audit procedure, you found that 35 purchases weren’t authorized. So, in the said method, you express the results as a number of occurrences of the attribute in interest. One of the dumb ways to indicate the attribute sampling’s result is it is expressed in an integer number, not a decimal one.

Variable Sampling

Variable sampling is a sampling method that reaches a conclusion on the monetary amounts of a population. It deals with continuous data dan provides quantitative estimation.

What’s continuous data, by the way? In the audit realm, the default is to deal with monetary value, which is continuous data. For example, the transaction value could filled with $100, $100.5, $5000.55, and so on.

Continuous data can take any value within a range. Say within the range of $10 to $12 could be filled with $10, $10.4, $10.9091, $11.6, and so on, you get the idea.

Another example of continuous data is people’s height data, which can be 5.5 feet, 5.61 feet, 6.01 feet, etc.

So, in conclusion, variable sampling is when you deal with transactions or account balances and estimate total value, average value, or amount of misstatement in a population.

Now, why is MUS also known as attribute sampling but expressed as variable sampling? That’s because Monetary Unit Sampling tests whether a transaction or account balance holds a certain attribute, in this case: misstatement, but instead of reporting the results in “how many misstated transaction”, it expresses the results as “there are $75500.56 misstatement on the financial statement.”

For this reason, MUS are:

- Attribute sampling, because it tests whether a misstatement or an attribute exists or is absent.

- Expressing the result in a monetary value, a.k.a continuous data.

A statistical method developed for audit

It began in 1960 when Deming published his work titled “Sample design in business research”, which proposed that a single dollar investment could serve as a sampling unit. Later in 1961, Van Heerden published the first known research on MUS applied to accounting populations. He defined the sampling unit as a guilder, a monetary unit. He suggested that an account balance or line item could be considered as a collection of monetary units, some of which were 100% correct and some were 100% in error (later, our field named it as an all-or-nothing method).

If you search for research about MUS, sometimes it is referred to as Dollar-Unit-Sampling (DUS). So don’t be confused; both MUS and DUS are the same.

Even though MUS was developed for the audit world, its roots are in statistics.

Using “monetary unit sampling” when talking with your statistics folks might confuse them. But when you say “an application of probability-proportional-to-size”, their eyebrows will lift a bit, and their eyes widen slightly with that “aha!” spark. So it’s time for the next alternative phrase for MUS.

An application of Probability-Proportional-to-Size (PPS)

MUS is standing on the shoulder of a giant named statistics, especially Probability-proportional-to-size (PPS). Hence, what’s PPS?

In short, the bigger the value, the higher the chance of being selected as a sample.

For example, consider you blindfolding and were asked to get one strawberry on the plate. Your chance of pulling strawberry B is greater than other strawberries. Henceforth the probability of strawberry A being picked is greater than the probability of strawberry C, and so on and so forth.

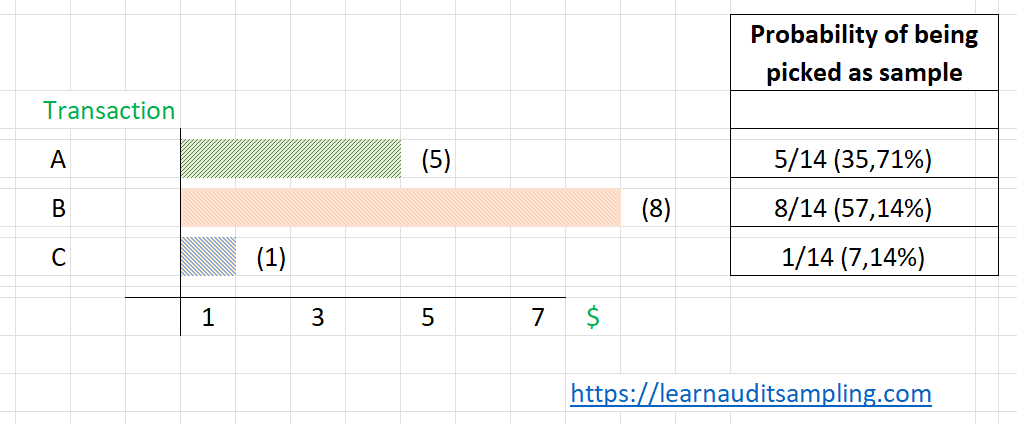

Mathematically you can calculate each strawberry’s probability of being touched as follows. As a note, the “strawberry” translates to “a transaction” so it’ll be contextual to our field.

For transaction A (or strawberry A, if you will), the probability is 5/14 or 35.71%. Transaction B has a higher chance, with a 57.14% probability. And the least probability goes to transaction C.

The same mechanics apply to MUS because it treats each $1 (or another monetary unit) as an individual sampling unit. Using the last data, transaction B contains 8 sampling units which makes it have the highest chance.

This feature, the bigger the value makes, the higher the probability, is crucial for the auditor because you tend to think that the bigger the value, the bigger the risk, thus making it bigger your interest to test it. That led us to our last terminology.

A sampling method ensures the bigger value has a higher chance of being evaluated

As previously elaborated, the MUS mechanism ensures the bigger transaction has a higher chance of being picked as a sample. This will please the auditors and other stakeholders because their confidence will be boosted when you tell them that you’ve covered the highest transaction in the population.

Conclusion

As a wrap, here are some examples of those terminologies we discussed earlier.

- “We are using statistical sampling in our audit engagement.”

- “It’s an attribute sampling but expressed as variables sampling, thus perfect for substantive test.”

- “We are utilizing a statistical method specifically designed for auditing.”

- “An application of probability-proportional-to-size sampling helps us focus on larger transactions, ensuring we efficiently detect significant misstatements.”

- “We have used a sampling method that ensures the bigger value items have a higher chance of being evaluated, improving our audit accuracy.”

Less boring, right?

Stay updated on the latest auditing techniques. Join our newsletter for insights and tips on enhancing your audit processes. Don’t miss out on valuable information—subscribe now!