Confidence Level in Monetary Unit Sampling is crucial in determining the precision and reliability of audit results. This blog post explores the significance of selecting the appropriate confidence level for auditors employing MUS, outlining its impact on audit quality and decision-making. Understanding this key aspect enables auditors to fine-tune their approach, ensuring that audit findings accurately reflect the financial state of the entity under review. Let’s examine how the confidence level influences the sampling process and the strategies for optimizing its application in audits.

Understanding the Confidence Level

In Short, the confidence level in auditing refers to the degree of assurance you, the auditor, have that the evidence supports the audit opinion. Confidence level also complements the risk of incorrect acceptance (it’s the possibility that you might conclude that a material misstatement doesn’t exist, or the control is effective, when, in fact, a material misstatement does exist, or the control isn’t effective). So, a high confidence level means you are confident enough that you wouldn’t make mistakes (to a certain level) in concluding the account balance.

Here are several definitions of confidence level from well-known sources.

Confidence level is the complement of the risk of incorrect acceptance. The measure of probability associated with a sample interval. Also referred to as reliability.

Whittington, Ray, and Kurt Pany. Principles of auditing and other assurance services

Confidence level (reliability) is the complement of the risk of incorrect acceptance. The measure of probability associated with a sample interval. For example, if an auditor accepts a 10% sampling risk, the reliability or confidence level is specified as 90%.

AICPA’s Audit Guide: Audit Sampling

The confidence level required from an audit test relates to the idea of audit risk. Essentially, suppose the auditor is willing to accept a high overall audit risk on a particular engagement or account. In that case, the confidence required from related tests can be relatively low (but never below minimum standards of care).

Pratt, Michael, Karen Van Peursem, and Mukesh Garg. Auditing Theory and Practice

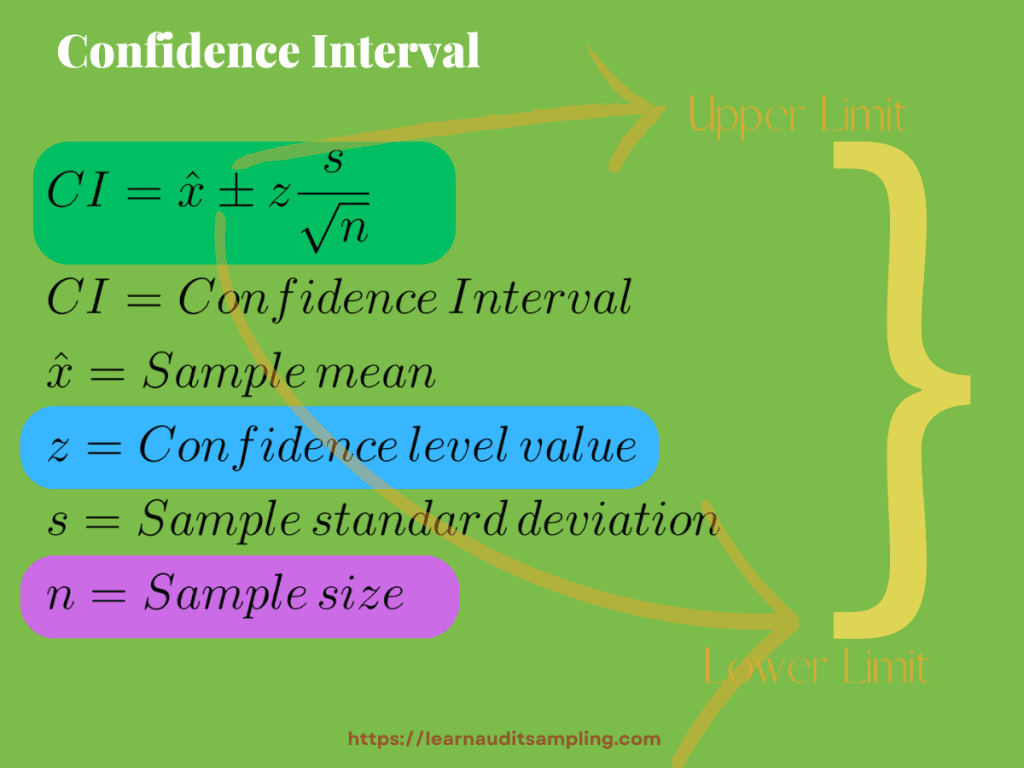

You can’t discuss Confidence Level without touching the Confidence interval. It is a statistical concept used extensively in research and auditing to estimate the range within which a population parameter (like a mean, proportion, or total misstatement) is expected to lie with a specified degree of confidence level. The confidence interval provides a way to quantify the uncertainty associated with a sample statistic.

Below is the equation of the confidence interval. As you might see, there is a plus-minus symbol representing two conditions. The upper limit is when the plus condition is used, and the lower limit is for the minus symbol. Between the lower and upper limits, there are numbers you believe the population parameter (for example, the population misstatement) falls.

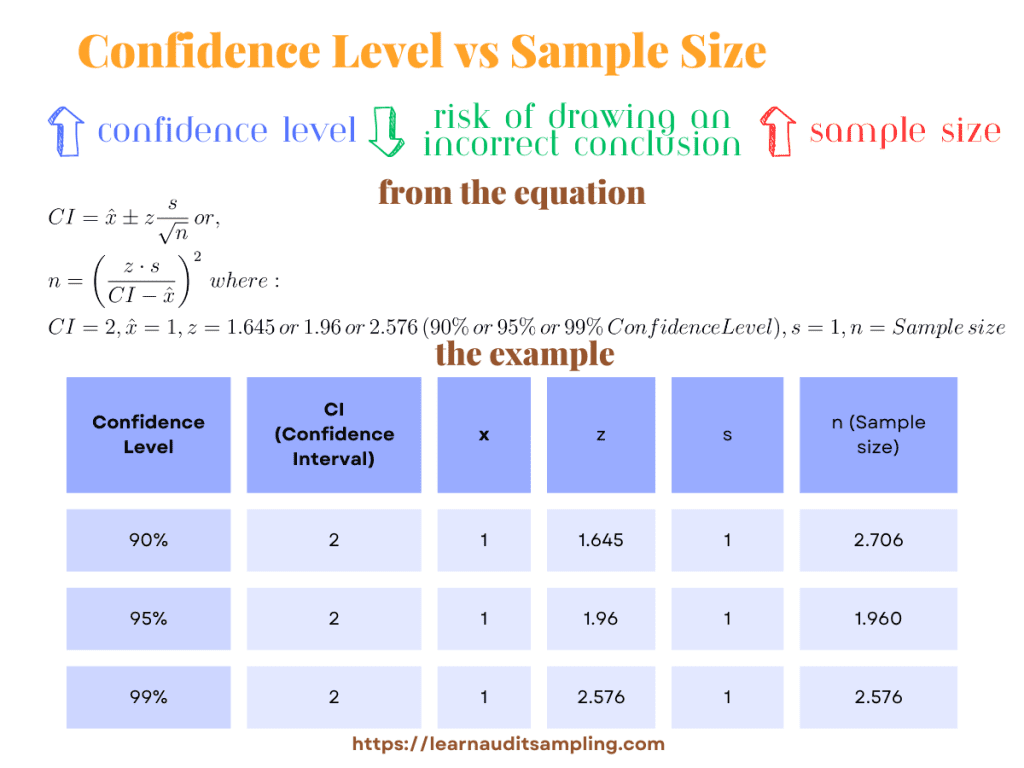

When deciding the range between lower and upper limits, you use confidence level and (drum roll) sample size. The confidence level has a positive correlation with the sample size. To increase your confidence, you must add the sample size. No kidding, here’s the proof.

Assume you want the same confidence interval (2) with various confidence levels (90%, 95%, 99%). For simplicity’s sake, the mean and standard deviation are the same for the three scenarios.

You might wonder what z is. It’s Z-Score for each confidence level. When calculating the confidence interval, you don’t use the confidence level directly but the Z-score for the confidence level you choose.

Plunging all values to the equation, you’ll get a bigger sample size for a higher confidence level. So, if you want more confidence in your sample (and then the audit’s conclusion), you must increase your sample size.

In the Monetary Unit Sampling realm, you are not using confidence level directly when determining the sample size or extrapolating the sample’s results. Instead, you’ll use the Risk of Incorrect Acceptance (100% – Confidence Level) or Confidence Factor; both directly correlate with the confidence level.

The Impact of Confidence Level on Monetary Unit Sampling

The impact is all around the place, from calculating the sample size to extrapolating the results from the sample. The confidence level in monetary unit sampling (MUS) impacts the precision of the results. A higher confidence level means that the auditor is more confident that the sample accurately represents the entire population. This results in a narrower margin of error and a higher confidence level in the conclusions drawn from the sample. Conversely, a lower confidence level widens the margin of error and decreases confidence in the conclusions. Therefore, the confidence level directly affects the reliability of the conclusions drawn from the MUS.

When using different angles, the confidence level in monetary unit sampling is directly related to the risk of incorrect acceptance. The confidence level is the measure of probability associated with a sample interval, also known as reliability. As the confidence level increases, the risk of incorrect acceptance decreases, leading to higher confidence in the sampling results.

In MUS, the confidence level is represented by the risk of incorrect acceptance, typically set at 5%, 10%, and 15%. The higher the risk of incorrect acceptance, the lower the confidence level, and vice versa.

As discussed before, the confidence level affects the determination of the sample size. As the risk of incorrect acceptance increases, the sample size required to achieve the desired confidence level also increases. This means that a higher confidence level will result in a larger sample size, providing greater assurance that the sample is representative of the entire population.

Additionally, the confidence level impacts the evaluation of sample results. The confidence factor, which is used to project the misstatement results of the sample to the population and calculate an allowance for sampling risk, varies based on the risk of incorrect acceptance. As the risk of incorrect acceptance increases, the confidence factor decreases, leading to a more conservative evaluation of the sample results.

Determining the Appropriate Confidence Level

Some agencies or audit firms determine the confidence level, which means you can use it, not question it. However, you can consider several factors to determine the appropriate confidence level for the audit assignment if you have more room.

- Risk tolerance: The level of risk that you and the organization are willing to accept will influence the choice of confidence level. A higher confidence level reduces the risk of drawing incorrect conclusions from the sample.

- Materiality: The materiality of the account balance or transaction being sampled will impact the choice of confidence level. Higher materiality may warrant a higher confidence level to ensure that the sample provides sufficient assurance regarding the accuracy of the balance.

- Audit objectives: The specific objectives of the audit test will also play a role in determining the confidence level. For example, tests of controls may require a different confidence level compared to substantive tests of balances.

- Expected error rate: Your expectation of the sampled population’s error rate will influence the choice of confidence level. A higher expected error rate may necessitate a higher confidence level to provide adequate assurance.

- Regulatory requirements: Regulatory or professional standards may prescribe minimum confidence levels for certain types of audit procedures, and these requirements must be taken into account.

- Cost-benefit considerations: The cost of obtaining a higher confidence level should be weighed against the benefits of the additional assurance. In some cases, a lower confidence level may be deemed sufficient based on the cost of increasing the sample size.

- Industry Practice: Confidence levels of 85% and 95% are frequently used in audit practice, but in some cases, a lower confidence level may be used, especially when you are developing overall confidence using other sources of information.

Challenges in Setting Confidence Levels in Monetary Unit Sampling

Setting the confidence level for monetary unit sampling involves several challenges. One challenge is determining the appropriate level of confidence that provides sufficient assurance without unnecessarily increasing the sample size. This requires a balance between the desired level of confidence and the practicality of conducting the sampling.

Another challenge is the interpretation of the confidence level. You must understand the implications of the chosen confidence level on the risk of incorrect conclusions. A higher confidence level reduces the risk of incorrect conclusions but may require a larger sample size, leading to increased time and cost.

Additionally, you must consider the impact of the confidence level on the risk of overreliance or under-reliance on the sample results. A lower confidence level may increase the risk of overreliance, while a higher level may lead to under-reliance on the sample findings.

Furthermore, the choice of confidence level should align with the specific audit objectives and the materiality of the sample account. Different accounts or assertions may require different confidence levels based on their significance to the financial statements.

Setting the confidence level for monetary unit sampling requires careful consideration of the trade-offs between confidence, sample size, risk, and the specific audit context.

Conclusion

Understanding the Confidence Level in Monetary Unit Sampling is essential for auditors seeking to enhance the accuracy of their findings. It’s a cornerstone of effective auditing, guiding us toward more reliable and insightful conclusions. By carefully selecting the confidence level, you can strike the perfect balance between thoroughness and efficiency in your work.

The right confidence level bolsters the credibility of audit outcomes and aligns audit efforts with the entity’s risk profile. This critical choice impacts the sample size and, consequently, the audit’s scope and depth. Auditors equipped with this knowledge can navigate the complexities of financial audits with confidence and precision.

Another interesting study about the confidence level and audit is the auditor’s confidence in their memory of the audit evidence. The research conclusion is surprising; the auditors are often as confident in their incomplete and inaccurate recognitions as they are in their accurate recognitions. But that’s a story for another day.

Elevate your auditing expertise by staying informed on the latest techniques and insights. Join our newsletter today and become part of a community dedicated to excellence in auditing. Subscribe now to ensure you never miss valuable updates and professional growth opportunities.

Cover image generated by DALL-E.