Monetary Unit Sampling bias can significantly impact the accuracy of your audit results. This bias occurs when the sampling process disproportionately includes larger monetary units, leading to unrepresentative samples. Understanding and addressing this bias is crucial for auditors to ensure their findings are reliable and reflect the entire population. In this blog post, we’ll explore the common cause of Monetary Unit Sampling bias and provide strategies to mitigate its effects, helping you conduct more accurate and effective audits.

Monetary Unit Sampling

Monetary Unit Sampling (MUS) is a statistical sampling technique commonly used in auditing to focus on larger monetary units within a population. This method ensures that transactions with higher values are more likely to be selected for testing. By emphasizing larger transactions, MUS helps you identify potential material misstatements more efficiently, providing a higher level of assurance about the accuracy of financial statements.

MUS is particularly useful in audits where the population contains a wide range of transaction values. The technique involves selecting sample items based on their monetary value, meaning larger items are more likely to be included in the sample. This approach reduces the need for extensive sampling of smaller, less material items, making the audit process more efficient and cost-effective. By prioritizing high-value transactions, MUS enhances the auditor’s ability to detect significant errors and ensures a more comprehensive evaluation of the financial statements.

Bias

What is bias?

As Wikipedia defines, bias is a disproportionate weight in favor of or against an idea or thing, usually in an inaccurate, close-minded, prejudicial, or unfair way. Another Wikipedia definition of bias is a systematic tendency in which the methods used to gather data and generate statistics present an inaccurate, skewed, or biased depiction of reality. For this post, we’ll use the first one as it is closer to the topic.

The (Wikipedia) page also points out an interesting sentence about bias.

Statistical bias results from an unfair sampling of a population, or from an estimation process that does not give accurate results on average.

Wikipedia

That is the same as what we’ll discuss today. An unfair sampling (that will) give inaccurate results on average.

Because you (when you) use unfair sampling, you may get inaccurate results, conclude your audit based on those results, and mislead the stakeholders or the audience of your audit report. I know that is exactly the scenario you want the least. However, MUS, by nature, holds a bias you should consider.

Bias in Monetary Unit Sampling

When using MUS, sometimes (oftentimes) you select samples that are not representative of the overall population. The condition happens because the method inherently focuses on larger monetary units, meaning the smaller items might be underrepresented or excluded. The lack of representation can skew the results and lead to incorrect conclusions.

MUS is an application of Probability-proportional-to-size (PPS) sampling, a statistics method that gives a higher probability of picking the larger items. This led to a sample that disproportionally consisted of high-value items. While this feature helps you identify significant misstatements, it can neglect smaller items that, in the aggregate, might also be significant.

Let’s take examples.

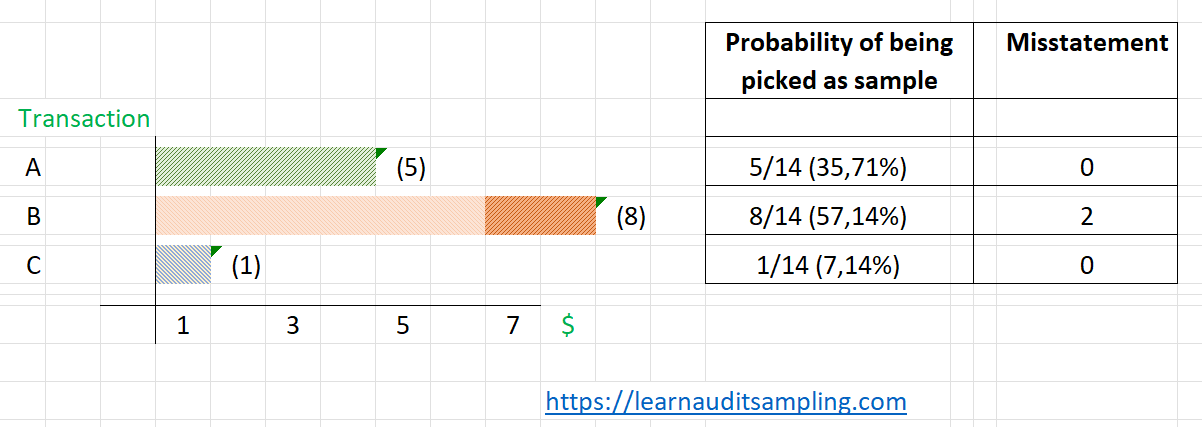

Say you have three items in the population. Using MUS, the probability of you selecting the larger items is higher. Thus, you’ll most likely pick transactions A and B if you need to pull two samples.

Imagine transaction B has a misstatement of $2. Then you proceed to the results and interpolate the misstatement. Because the misstatement is below the Tolerable Misstatement, you conclude that you can give the financial statement an unqualified opinion.

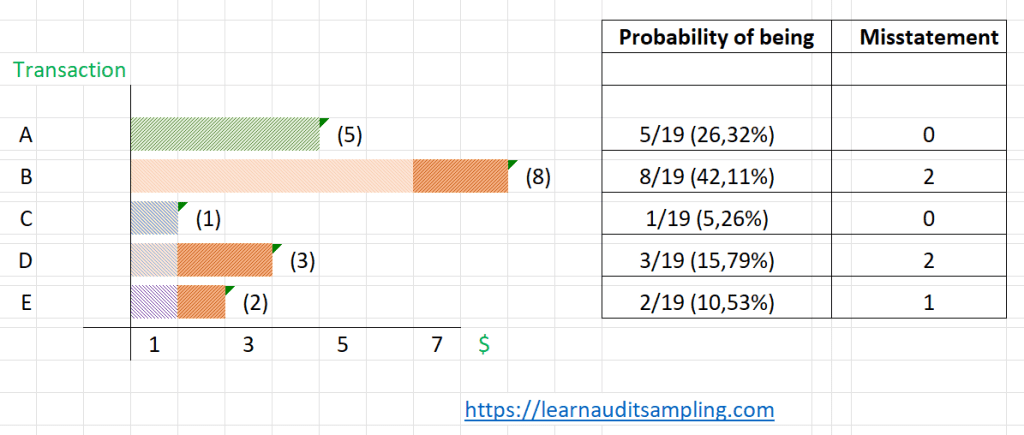

Now, let’s shift the scenario a bit. Two additional items, transactions D and E, are in the population; both have relatively small values and, consequently, have lower probability.

Again, you only pick two samples, transactions A and B, find the misstatement in B, and conclude that the financial statement is okay. Unfortunately, there are misstatements in transactions D and E, which, if aggregated, make a misstatement of $3. That misstatement is greater than the Tolerable Misstatement, and you wouldn’t give an unqualified opinion if you found the misstatement in transactions D and E.

It’s a gross, inaccurate simplification, but you get the idea.

As pointed out before, MUS naturally picks the higher value, which is a bias and could miss the smaller items. The problem is that the smaller item could contain the misstatement, which, if aggregated, could be significant.

The Consequences

Consequently, you may miss something significant, and in the end, you couldn’t provide accurate conclusions that reflect the true state of the population.

“But if I know my sample has flaws, I can add more samples,” you thought. Yes, but that’ll trigger another consequence, the inefficient audit. Adding samples demands additional resources (time and costs).

How to Reduce the Bias

However, you can reduce the bias to enhance your audit accuracy by applying the strategies below.

Perform a proper stratification

By default, MUS doesn’t need any stratification. However, we could apply “stratification” to the population to avoid bias. For example, you could divide the population into low, medium, and high strata.

AU-C section 530 in paragraph .A15 says, “The auditor might first separately examine those items deemed to be of relatively high risk and then use audit sampling…” This implies that you can exclude some items from the population to test separately. The rest of the items will then be processed as usual. If the larger items are removed from the population, the smaller items probability will increase.

Christensen’s study gives another idea. You can exclude all items greater than tolerable misstatement to test separately.

Regularly review and adjust the samples

You can continuously review the sample composition and/or results during the audit to ensure they remain representative and make adjustments as necessary.

To illustrate, say you have already tested some portions of the samples and found misstatements. The current sample, however, is less representative of the smaller items. Because you are worried about the results, you want to ensure that the phenomenon for the smaller items is (or isn’t) the same as for the larger items; thus, you want to adjust your samples.

The regular review may be a wake-up call, which will help you respond better.

Apply your professional judgment

The previous strategy heavily relies on your professional judgment, a tool you always need in the audit realm. You can also apply professional judgment in another scenario to reduce the monetary unit sampling bias. For example, when calculating the sample size, there are tolerable misstatements, expected misstatements, and risks of incorrect acceptance, which use your professional judgment when making decisions. Using professional judgment to “intervene” in the sample size could also reduce bias.

Conclusion

Monetary Unit Sampling bias can significantly impact the accuracy of your audit results. Understanding and addressing these biases is crucial. Effective auditing requires awareness and proactive measures to ensure unbiased sampling. Regular reviews and professional judgment help maintain the integrity of the audit process.

To stay updated on the latest auditing techniques and best practices, including more insights on Monetary Unit Sampling, subscribe to our newsletter today. Don’t miss out on valuable tips and strategies to enhance your audit processes and ensure reliable financial reporting. Subscribe now and take your auditing skills to the next level!