The risk of incorrect acceptance (RIA) is used to calculate the sample size in the Monetary Unit Sampling (MUS). Why is that? And how do we determine one? Let’s discuss.

What is Incorrect Acceptance?

Incorrect acceptance is when you mistakenly accept a financial statement that contains material misstatement. So, the risk of incorrect acceptance is the possibility that the auditors conclude that the recorded account balance is not materially misstated when, in fact, it is materially misstated.

If there’s a chance you falsely conclude that the financial statement is okay while it contains material misstatements, you may wonder if there is any chance for the opposite. Can you conclude that the financial statement isn’t okay but that the true state is okay? Yes, of course.

And, as you expect, we already have the name for such a condition. It’s an incorrect rejection. For the said error, we’ll cover it in another post.

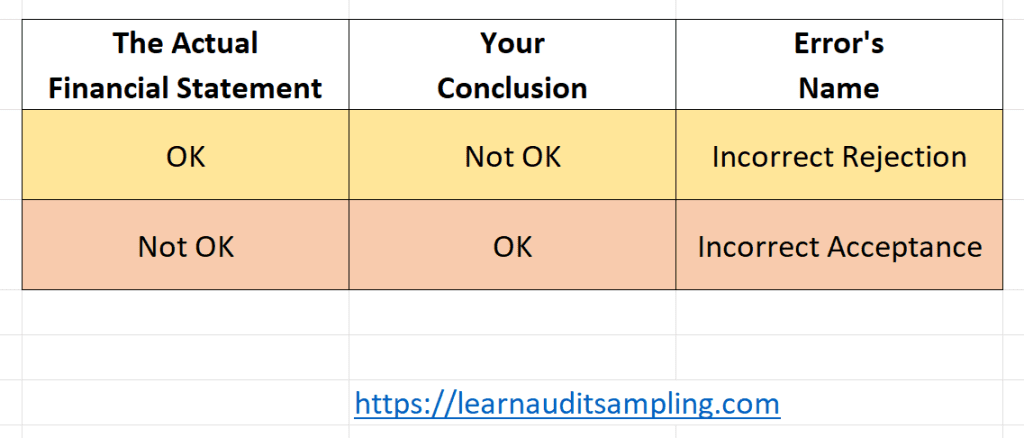

Below is a quick way to determine which scenario is an incorrect rejection or an incorrect acceptance.

Please note that “OK” means “No material misstatements“, and “Not OK” means “there are material misstatements.”

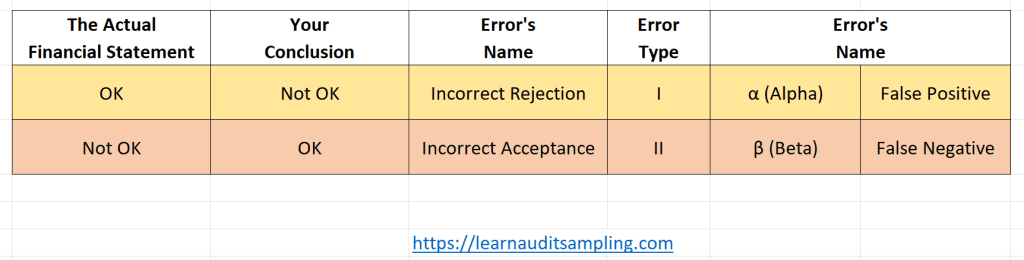

Both the risk of incorrect acceptance and incorrect rejection aren’t exclusive to audit. People outside the audit realm use “error type I” for “incorrect rejection” and “error type II” for “incorrect acceptance”. Another term is also used as a synonym for both conditions. Here are the terms compilation.

The Causes

Several conditions trigger incorrect acceptance, such as the one below.

Non-representative samples

Selecting samples that aren’t representative of the entire population increases the likelihood of missing significant misstatements. Unfortunately, MUS has a bias to tend to ignore smaller items; thus, you may perform preventive steps.

Insufficient sample size

Using a sample size that is too small can result in an inadequate evaluation of the population, increasing the risk that material misstatements are overlooked.

Lack of professional skepticism

I never knew auditors could run out of skepticism, but sometimes we do. Sometimes, we lack skepticism, accepting evidence at face value without critically evaluating its reliability or consistency. You must question and probe deeper, especially when dealing with complex or unusual transactions.

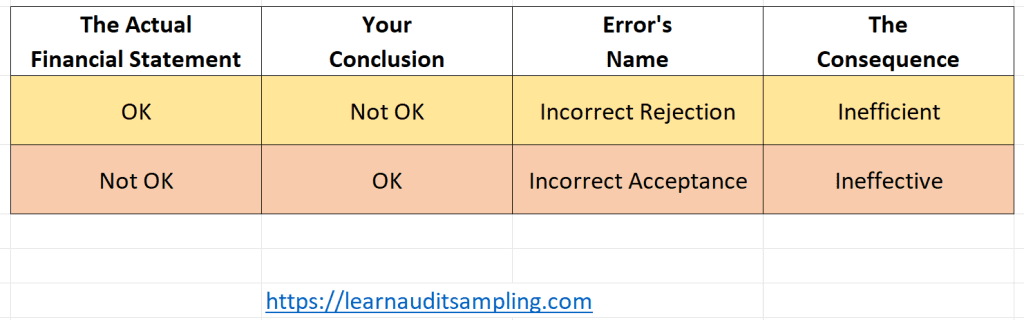

The Consequences

The direct consequence of incorrect acceptance is “ineffective audit.” Someone pays us to look at the financial statement and tell them when something is off, but somehow, we didn’t do that; thus, we fail at our job.

Then another consequence arises, “misleading financial report.” Because we, the auditor, say that the financial statement is OK, when it doesn’t, the reader is misled and potentially has financial losses.

When material misstatements are discovered after the audit has incorrectly accepted the financial statement, your firm will face increased scrutiny from regulatory bodies. Which then leads to fines, sanctions, or other regulatory actions.

In the worst case, shareholders and creditors who suffer losses may initiate legal actions against your firm, resulting in costly litigation and reputational damage.

The Relationship Between Risk of Incorrect Acceptance and Monetary Unit Sampling

Monetary Unit Sampling is a statistical sampling method, meaning you pick the samples, assess them, and then project the sample results to the population. With the mechanism, you know there is always the chance for you (your samples) to lead to a conclusion different from the true state of the population.

In other words, you have confidence (confidence level) that your sample is representative enough, but on the other hand, you also have room for error. For example, with a 95% confidence level of the samples resulting in the correct conclusion, you’ll have a 5% error (risk of incorrect acceptance).

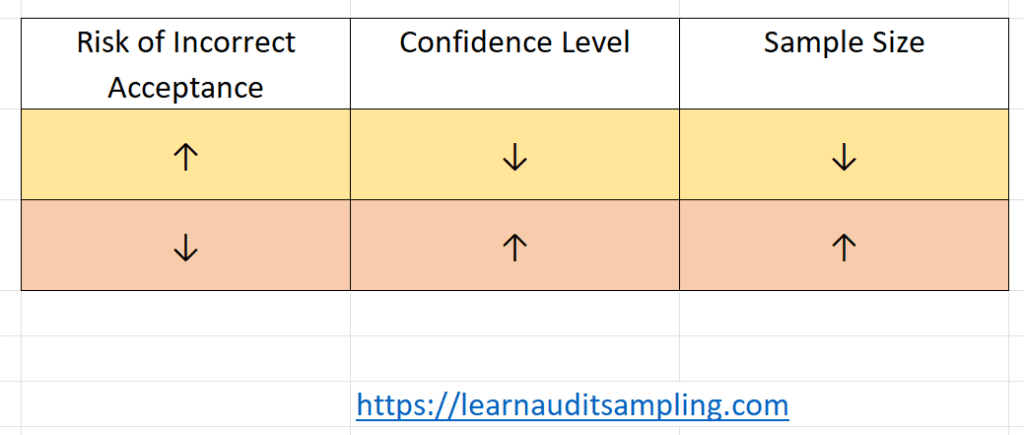

In MUS, considering the risk of incorrect acceptance, you calculate the sample size. The smaller the RIA, the higher the confidence level, and the more you need sample size.

How to Calculate RIA

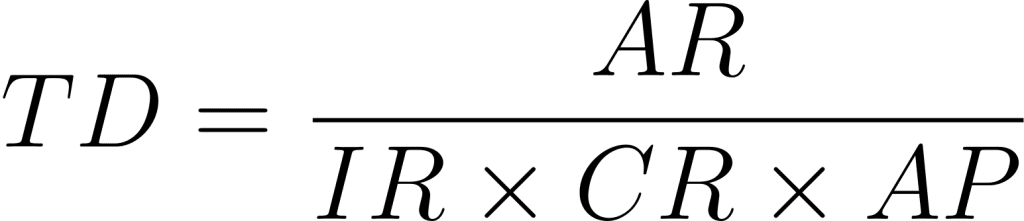

PCAOB’s AS 2315 offers a formula to calculate RIA. Here is how we calculate the audit risk and use the formula to calculate RIA.

Where.

- AR = Audit Risk

- IR = Inherent Risk

- CR = Control Risk

- AP = The risk that analytical procedures (and other relevant substantive test) would fail to detect misstatements

- TD = Risk of Incorrect Acceptance for the substantive test

How to Mitigate the RIA

We can’t eliminate the risk of incorrect acceptance. But at least there are some steps we could employ to minimize it.

- Use representative samples.

- Utilize proper sample size.

- Applying professional skepticism. For example, maintaining a questioning mindset and critically evaluating all audit evidence. Also, verifying information independently rather than relying solely on management’s representations helps you gather better evidence.

- Use audit software. The tool helps you ensure that sample selection is statistically valid and bias-free. These tools can also help calculate the appropriate sample size and identify anomalies in the data.

- Leverage data analytics. Utilize data analytics to analyze large volumes of financial data quickly and efficiently. Other benefits include identifying patterns, trends, and outliers that might indicate potential misstatements.

Conclusion

The risk of incorrect acceptance isn’t something we can avoid. As long as we do the audit using sampling there is the risk of incorrect acceptance.

Understanding and addressing the risk of incorrect acceptance is vital for ensuring the integrity and reliability of financial audits. Incorrect acceptance, where auditors conclude that financial statements are free from material misstatement when they are not, can have serious consequences, including misleading financial reports, regulatory scrutiny, and loss of stakeholder trust.

By recognizing the common causes of incorrect acceptance, such as inadequate sampling techniques, poor audit procedures, and insufficient auditor judgment, auditors can take proactive steps to mitigate these risks.

Stay ahead in your auditing practices and ensure the accuracy of your financial statements by implementing the strategies discussed in this blog. Subscribe to our newsletter for more expert insights, practical tips, and the latest updates in auditing techniques. Join our community of professionals committed to maintaining the highest standards of audit quality and integrity. Don’t miss out on valuable resources that can enhance your audit process and help you mitigate risks effectively. Subscribe now and elevate your auditing skills to the next level!