The risk of incorrect rejection occurs when the auditors conclude that the financial statement is materially misstated when, in fact, it is not. This leads to unnecessary additional testing and adjustments, which eats up your resources and leads to miscommunication with stakeholders. In this post, we will explore the causes and consequences of incorrect rejection, how it relates to Monetary Unit Sampling (MUS), and strategies to mitigate the risk.

What is the Risk of Incorrect Rejection

Incorrect rejection occurs when the auditors incorrectly reject the financial statement (or account balance) because the samples convince him/her that there are material misstatements.

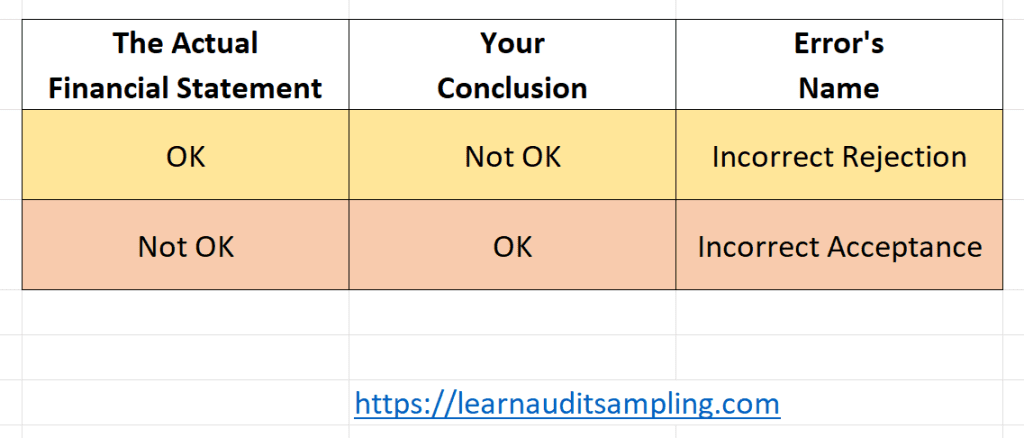

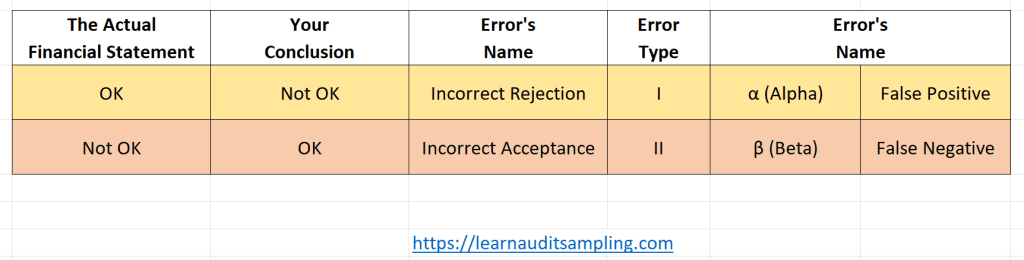

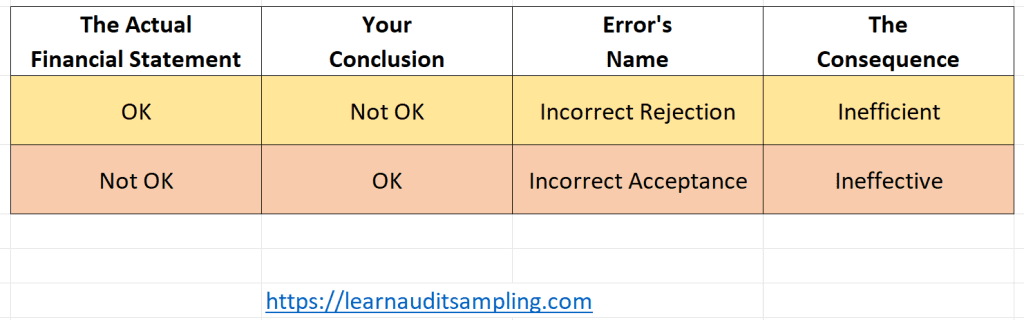

Please do not confuse this with the other risk, the risk of incorrect acceptance, which occurs when you incorrectly accept the account balance when, in fact, it contains material misstatement. Here is the difference between those two risks.

As a side note, sometimes people outside the audit or accounting world also use error type I or false positives to refer to incorrect rejection. And alas people don’t talk much about the risk of incorrect rejection.

When your samples indicate material misstatements, it naturally pushes you to expand your testing or increase your sample size to confirm your findings. Unfortunately, after performing the necessary additional procedures, you might discover that there are no material misstatements. This means the extra time and cost invested in those additional procedures have not added any real value. It’s a frustrating scenario that no one wants to encounter.

What Causes the Risk of Incorrect Rejection?

What scenarios can trigger incorrect rejection? Here are some.

Inadequate sample size

When the sample size is too small, it may not adequately represent the population. The situation can lead to misleading conclusions about the presence of misstatements. You might detect anomalies that aren’t indicative of a broader issue, leading to incorrect rejection.

Bigger (sample size) doesn’t always mean better.

You might also need to increase the variability of your samples. Because even if you have a bigger sample size but it’s too homogen, for example only addressing certain types of transactions, the samples couldn’t accurately represent the population.

Overemphasizing certain items

Imagine, if you are placing too much focus on high-risk or high-value items without a balanced approach, and then you find a decent amount of misstatement. So you conclude that the population is materially misstated. Unfortunately after taking samples of other groups, say mid-value items, you didn’t see the same misstatements happen. The discrepancies between the results of those two groups of samples point out that your former conclusion doesn’t accurately represent the population.

One thing deserves consideration. Monetary Unit Sampling naturally tends to focus on high-value items. To ensure reducing the risk of incorrect rejection, it’s crucial to mitigate this tendency and avoid overemphasizing the high-value group.

Misinterpretation of audit evidence

Misinterpreting anomalies or unusual items as errors can lead to incorrect conclusions. For instance, a transaction that appears irregular might have a valid explanation that wasn’t considered during the initial review, such as a legitimate adjustment or a one-time event.

What are the Consequences?

Simply put, the incorrect rejection makes your audit inefficient.

But if you zoom in a bit, you’ll get other consequences of the incorrect rejection, such as elaborated below.

Unnecessary additional testing

If you find material misstatements that are later proven wrong, you are required to perform additional procedures to investigate these perceived issues. This involves re-examining documents, increasing sample sizes, and potentially conducting more extensive tests. Such extra work is often unnecessary and consumes valuable time and resources that could have been better spent elsewhere. It not only leads to increased audit costs but also delays the completion of the audit.

Moreover, this additional effort does not contribute to the audit’s overall effectiveness, as it focuses on resolving non-existent problems rather than identifying and addressing real risks and misstatements. This misdirection of efforts can diminish the audit’s efficiency.

Increased audit cost and time

Additional testing increases cost and time for both the auditor (firm) and the client. For the audit firm, the need for extra procedures means allocating more resources, such as staff hours and possibly even specialized expertise, which directly raises the audit costs. These increased expenses can strain the audit budget, reducing the engagement’s profitability and potentially impacting the firm’s overall financial performance.

The scenario also caused delays in the completion of the audit and the issuance of the audit report. Because the extra work to investigate perceived issues will stretch the audit schedule and push back critical milestones.

On the client’s side, the disruption caused by additional testing can interfere with their normal business operations. This often translates to extra costs for the client, including the time spent by their staff to support the auditors’ extended work and potential delays in their internal processes.

The delay impacts the client’s ability to meet their reporting deadlines, potentially affecting regulatory filings, investor communications, and strategic planning. Moreover, the extra costs and delays can disrupt the client’s internal processes and timelines, leading to frustration and added pressure on their financial and management teams.

Resource allocation

Another thing to consider is that incorrect rejection diverts audit resources away from other critical areas that may require attention. When auditors mistakenly identify a population as misstated, they are compelled to allocate additional time and effort to verify these findings. This unnecessary focus can lead to the neglect of other significant audit areas where actual risks and misstatements might exist.

Consequently, the overall effectiveness of the audit is compromised, as resources are not being optimally utilized to address the areas of highest risk. This misallocation can result in a less comprehensive audit and potentially allow genuine issues to go undetected, undermining the quality and reliability of the audit findings.

Decrease in trust

Incorrect rejection can lead to a false alarm, causing the auditor to report non-existent issues to the client. This creates unnecessary concern among stakeholders, including management, investors, and regulatory bodies, who rely on the auditor’s judgment for accurate financial reporting. Frequent occurrences of such false alarms can significantly erode trust in the auditor’s capabilities. Over time, this erosion of trust can severely damage the auditor’s reputation, making it difficult to maintain credibility in the industry.

When clients lose confidence in the audit process, they may begin to question the value and reliability of the auditor’s work. This skepticism can lead to strained relationships and dissatisfaction with the audit services provided. As trust diminishes, clients might seek alternative firms for future engagements, reducing the auditor’s business opportunities.

The Relationship Between Incorrect Risk and Monetary Unit Sampling

Generally, the incorrect rejection and monetary unit sampling met on two occasions.

Monetary Unit Sampling increased the Risk of Incorrect Rejection

As previously discussed, unfortunately, monetary unit sampling has a bias, leading to a higher risk of incorrect rejection. MUS inherently focuses on higher-value items, leading to overemphasis on certain types of samples. Because the goal of using sampling is to project the samples’ results to the population, if you get material misstatements in the sample, which isn’t representative of the population, you’ll believe that the population is also materially misstated.

The risk of Incorrect Rejection is a factor in the Sample Size formula

As AICPA says, your expected misstatement is a tool for controlling the risk of incorrect rejection. The expected misstatement was then used to calculate the sample size. In simple terms, the formula for determining sample size takes into account the expected misstatement to ensure that the sample is representative of the population. When the risk of incorrect rejection is high, it means there’s a greater likelihood that the auditor might mistakenly conclude that there is a material misstatement when there isn’t one. To mitigate this risk, auditors increase the sample size.

Increasing the sample size may helps reduce the risk of incorrect rejection, but you also must consider the sample variability as discussed previously.

How to Mitigate the Incorrect Rejection in Monetary Unit Sampling

Ensuring adequate sample size

You must use the proper sampling size formula. Using audit software or a proven Excel template could help you with the issue.

Further, AICPA also points out, that you could increase the sample size for the substantive test to limit the risk of incorrect rejection. You also could add a percentage of items (say, 10 percent) to the computed sample size, but the method does not specifically control how much protection is obtained.

Applying proper sampling techniques

There are several sampling selections you can use in MUS, each with its strengths. However, to reduce the MUS bias to high-value items, you may also stratify the samples. Stratification involves dividing the population into different subgroups or strata based on certain criteria, such as transaction size or type. By doing so, you ensure that each stratum is appropriately represented in the sample, balancing the focus between high-value and low-value items.

Enhance training

To minimize misinterpretation of audit evidence, ensure the auditors participate in ongoing training and professional development programs. By that, the firms can significantly enhance the accuracy and reliability of their audits. This commitment to continuous learning not only minimizes the risk of misinterpreting audit evidence but also strengthens the overall quality and credibility of the audit process.

Conclusion

Understanding and managing the risk of incorrect rejection is crucial, especially when monetary unit sampling is used because the method inherently has a bias which can increase the risk. The risk of incorrect rejection is the risk of the auditors incorrectly rejecting the financial statement because the sample supports the conclusion when, in fact, the financial statement doesn’t contain material misstatements.

The risk is caused by several things as inadequate sample size, overemphasizing certain items, and misinterpreting audit evidence. The situation leads to consequences such as unnecessary additional testing and increased cost and time. Impelementing best practices such as ensuring proper sample size, proper sampling technique, and enhanced training might reduce the risk of incorrect rejection.

By understanding the risk and inherent bias in monetary unit sampling, you can optimize MUS and get the most from it, without losing your confidence.

Stay updated on the latest auditing techniques. Join our newsletter for insights and tips on enhancing your audit processes. Don’t miss out on valuable information—subscribe now!