The taint method in Monetary Unit Sampling (MUS) helps the auditors calculate each error found on the sample. The method plays a crucial role in the MUS realm; thus, it’s wise to understand the subject. We’ll cover the advantages, challenges, and the alternative. Let’s dive in.

What’s the Taint Method in Monetary Unit Sampling

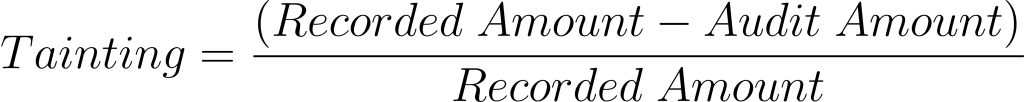

Tainting is the percentage of misstatement, as stated by the AICPA in its guide, Gray, Whittington, and Horgan. This means you divide the misstatement’s value by the line item/transaction’s recorded value. Horgan explains that the taint method assumed the errors to be distributed equally among all the monetary units in the line item (or transaction).

The method comes into the scene when the auditors project the misstatement. If the sample has a misstatement, the taint will project to the sampling interval and, at the end, project to the entire population.

Calculating the Tainting Percentage

The method is dead simple. Calculate the misstatement by subtracting the recorded amount from your audit results and dividing it by the recorded amount.

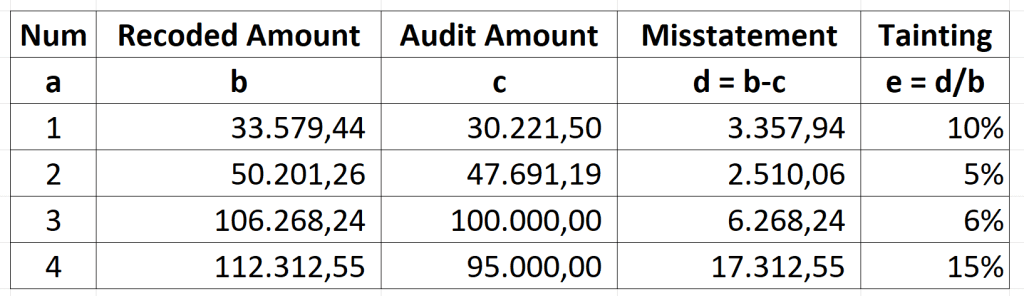

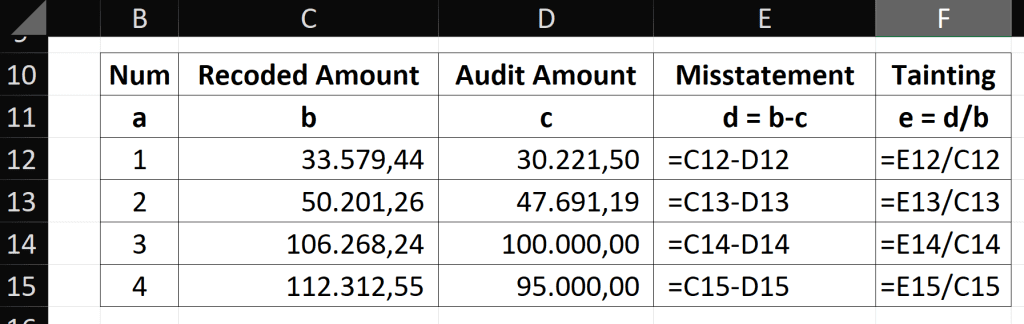

Here is an illustration of how to calculate the tainting percentage in Excel.

Suppose you are processing your audit results after calculating the tainting percentage. In that case, you then need to multiply the values by the sampling interval to get the projected misstatement of each sample.

The Excel formula in the above image is below. Super easy.

Benefits of the Taint Method in Monetary Unit Sampling

Although the taint method is “glued” to the Monetary Unit Sampling method, and you seem to have no other option, the method offers some benefits. So, at least the option you are left with is good.

- Identification of Misstatement: The taint method helps identify errors in the sample by calculating the difference between the book value and the audited value of an account.

- Increase visibility of small errors: With the taint approach, small error amounts on large line items are more likely to be detected. In other words, it provides a better chance of identifying and capturing small errors within larger line items. This increased visibility of small tainting is beneficial as it allows auditors to more effectively identify and address minor discrepancies or inaccuracies within the larger context of the sampled line items.

- Proportionally distribute the error: The method assumes that errors are distributed equally among all the monetary units in a line item. This method allows for more uniform treatment of errors within a line item/transaction, ensuring that each monetary unit is considered to have an error amount proportional to its share of the total line item value.

- Extrapolation: It allows auditors to extrapolate from the errors found in the sample to estimate the error level in the entire population, providing a basis for making conclusions about the population.

- Determination of Upper Limit on Misstatements: It aids in determining the upper limit on misstatements by calculating the components of the allowance for sampling risk, including the basic precision and the incremental allowance.

- Confidence in Results: By using the taint method, auditors can determine the range of error in the population at a particular confidence level, contributing to the statistical basis for their conclusions.

- Scientific Approach: The taint method aligns with the scientific approach to auditing, providing a mathematical basis for confidence in the results obtained from the sample.

Challenges and Limitations

Feel optimistic about the method? Good. However, there are some considerations when using the taint method.

- Relies on the auditors’ ability: One challenge of the taint method is that it relies on the auditors’ ability to identify and quantify errors in the sample, which can be subjective and prone to human error.

- It may not effectively detect fraud, Especially when it is well-planned, complex, and involves collusion, as it assumes that errors in the sample are representative of errors in the entire population. This may not hold in cases of sophisticated fraud.

- It introduces uncertainty: The taint method requires you to extrapolate from the errors found in the sample using their level of tainting, which introduces uncertainty and the potential for inaccuracies in estimating errors in the entire population.

- Lack of Mathematical Justification: As pointed out by Horgan, unlike the AON approach (we’ll discuss it later), the taint method lacks a solid mathematical basis. This can limit its reliability and raise concerns about the accuracy of the results obtained using this method.

Comparison with Other Estimation Methods

With the taint method’s challenges, is there any other option to handle the error you found on the sample? Yes, there is.

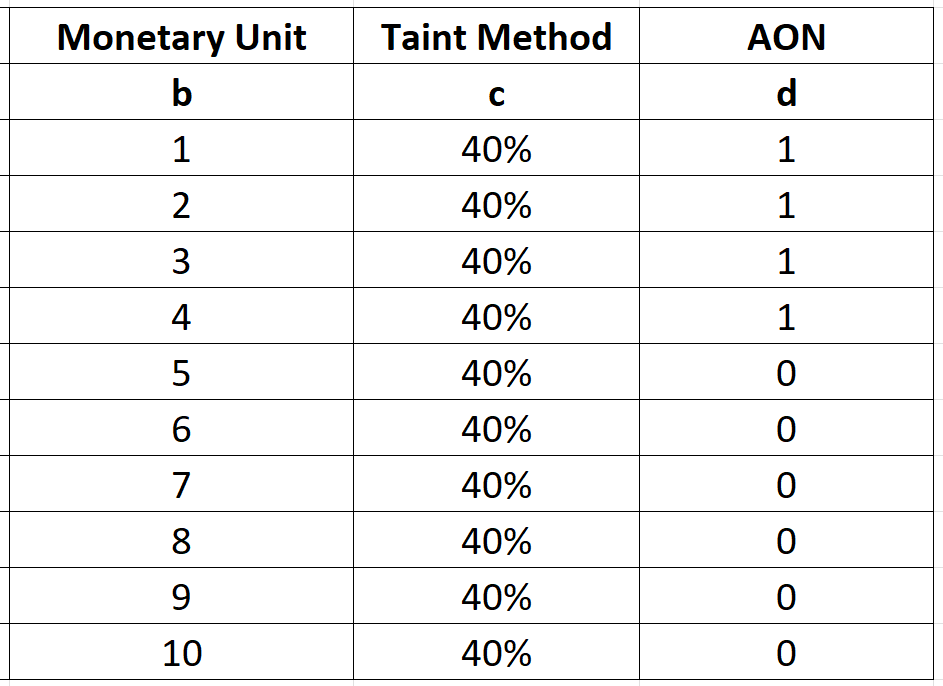

The alternative to the taint method in monetary unit sampling is the “all-or-nothing” (AON) method of error assignment. Unlike the taint method, this method does not assume an equal distribution of errors among all monetary units in a line item. Instead, it assigns the entire error amount to the selected monetary units, considering them either entirely erroneous or entirely correct.

Assume you found a $10 transaction that has misstatement. Based on your audit result, the correct value is $6 instead of $10. The taint method will distribute the misstatement equally to all monetary units. On the other hand, AON labels only the four monetary units (usually the first one) for error, which has an error. As illustrated below.

As you may see in the previous image, the AON method allows for a precise allocation of errors to individual monetary units, ensuring that there is no ambiguity regarding the correctness of each unit within a line item. Additionally, by clearly defining the incorrect units within a line item before sampling, this method provides a structured approach to error assignment, contributing to the overall efficiency and accuracy of the sampling process.

As stated by Horgan, the AON method is statistically valid. However, there are serious disadvantages; for example, one major issue is that it produces more variable results than the Taint Method when assigning errors. Leslie, Teitlebaum, and Anderson (as cited in Horgan) point out that the AON approach “loses the benefit of the increased visibility of small taintings in the many audit applications where small taintings are typical.”

After a quick search on Google Scholar for AON, I found nothing new besides Horgan’s study in 1994. It seems the auditing realm prefers other than the AON method.

Conclusion

The Taint Method in Monetary Unit Sampling equips auditors with a robust framework for detecting and quantifying misstatements accurately. This technique refines the audit process, ensuring that financial statements reflect actual economic activity more reliably. It’s an invaluable tool for auditors aiming to provide thorough and precise financial inspections.

Understanding and applying the Taint Method can significantly enhance your auditing practice, helping you confidently address complex financial records. It allows for a nuanced approach to auditing, turning raw data into actionable insights that can influence business decisions and compliance assessments.

Elevate your auditing skills by staying updated with the latest methodologies. Join our newsletter for more insights and updates on essential auditing techniques. Subscribe now and become part of a community dedicated to audit excellence. Share your experiences and queries about the Taint Method in the comments below.