Expected Misstatement use in Monetary Unit Sampling (MUS) to calculate the sample size and another benefit you’ll realize soon. The expected misstatement itself is the auditor’s (your) estimated amount of error anticipated will be found in the population (account balances). Because expected misstatements were utilized in deciding the sample size, in the audit planning phase, properly determining the expected misstatements will help you allocate the audit resources better. As a result, you can deliver reliable audit output more efficiently. This time we’ll elaborate on the concept of expected misstatement, its correlation to MUS, and the impact on audit engagement.

What is the Expected Misstatement?

Expected misstatement is the auditors’ estimate of the dollar amount of misstatement that may exist in the population without causing the financial statements to be materially misstated.

Definition by Whittington’s

Let’s elaborate on the definition.

“The auditors’ estimate.” So, it’s your estimation, based on several factors, we’ll elaborate more in the following section. Because it’s an estimation, it could be whatever dollar (or any currency) number, even zero a dollar estimate.

Because it’s an estimation, meaning isn’t proven yet, you couldn’t use it as a discriminant between a materially misstated financial statement or not. For that purpose, you’ll use the tolerable misstatement number. However, together with tolerable misstatement, expected misstatement is used for determining the sample size in the substantive test.

Expected Misstatement and Sample Size

AU-C Section 530 .A13 says that the expected misstatement (along with your desired level of assurance, tolerable misstatement, and if applicable, stratification) influences the sample size in substantive tests. For tests of controls, there are tolerable rate of deviation, expected rate of deviation, desired level of assurance, and the number of sampling units in the population, which influence the sample size.

AICPA Audit Sampling’s Guide gives hints on the correlation between expected misstatement and sample size.

Used in Nonstatistical and Monetary Unit Sampling

As we are aware, there are nonstatistical and statistical sampling methods in audit, especially in the substantive test. In the statistical category, there are MUS and classical variables sampling. While all three sampling methods require you to decide how many samples to evaluate, expected misstatement plays a direct role only in the nonstatistical and MUS. On the other side, when using classical variables sampling, you don’t need expected misstatement.

Below is the equation to get the sample size, in the nonstatistical method. The auditor gets the confidence factor from Table C-2, which needs the Ratio of Expected to Tolerable Misstatement.

Where do you get the confidence factor? It’s from Table C-2. The table, however, needs the Ratio of Expected to Tolerable Misstatement, described below.

Ergo, you need expected misstatement to calculate sample size in the nonstatistical approach.

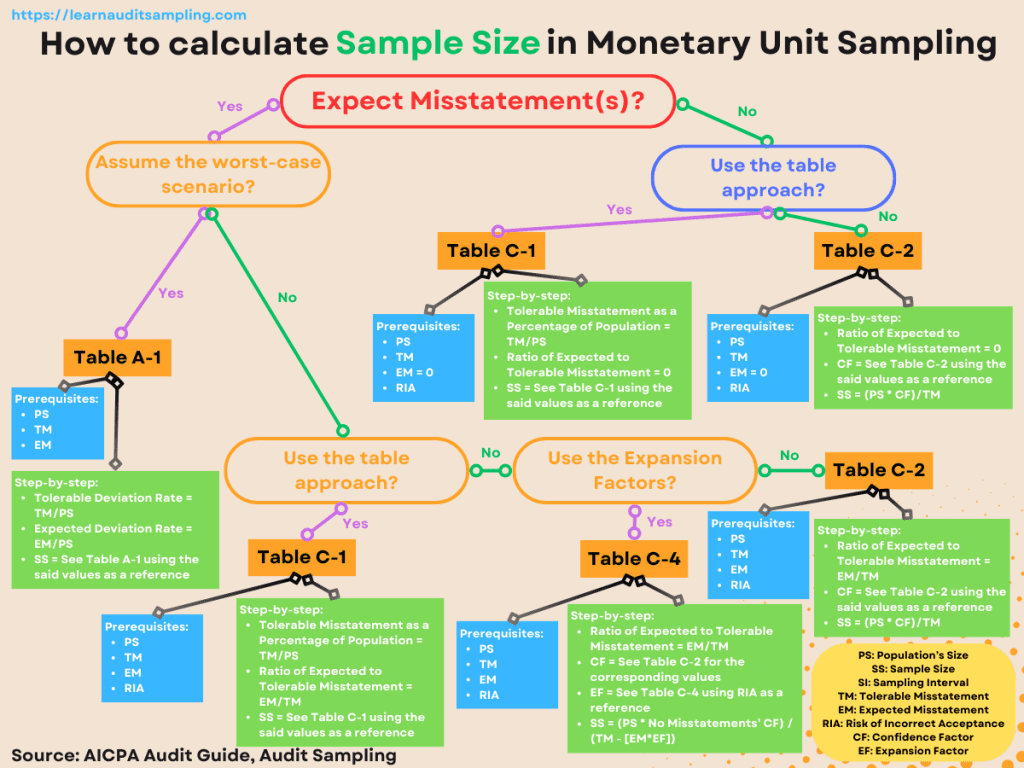

If you are using MUS, there are a couple of scenarios, here is the summary.

As you can see, both previous methods employ expected misstatement. However, when using classical variables sampling, you don’t utilize it. As Footnote 6 (page 119) on AICPA Audit Guide: Audit Sampling says, “Expected misstatement, a common sampling parameter (see paragraph .A13 of AU-C section 530, Audit Sampling [AICPA, Professional Standards]), is not used directly in the sample size calculation for a classical variables sample, but an estimate of the frequency and size of expected misstatements may nevertheless assist the auditor in assessing the potential variability, setting a precision for the sample, and selecting an appropriate classical variables sampling technique (for example, mean per unit, difference, or ratio technique).”

Another part of the guide (paragraph 7.27 on page 120) also says, “In the case of classical sampling techniques where expected misstatement may not be used in determining the sample size, other sampling parameters such as measures of variability may provide evidence that the characteristics observed in the sample were properly considered when the sample was designed.”

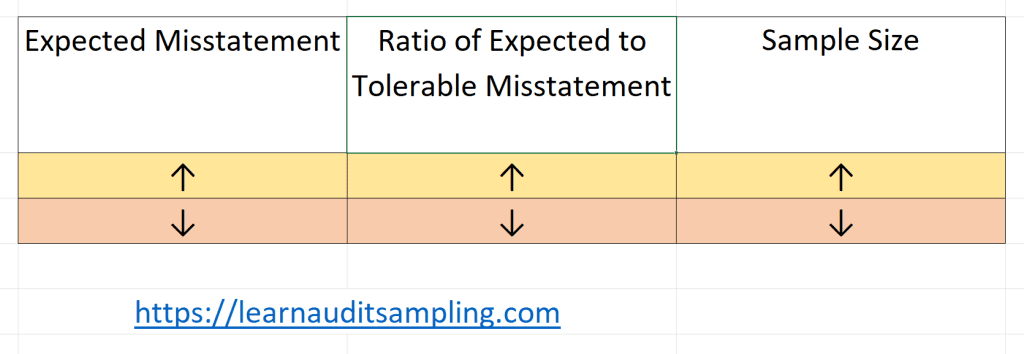

Higher Expected Misstatement = Larger Sample Size

The higher the expected misstatement, the bigger the sample size is.

As you may see in the previous section, the sample size for the nonstatistical method’s equation has the confidence factor as a numerator. The confidence factor is influenced by the ratio or expected to tolerable misstatement, which has the expected misstatement as the numerator. In short, the higher the misstatement, the higher the sample size.

As an intermezzo, you can use “positive correlation” as a fancier term. For example, you can say to your colleague, “The expected misstatement has a positive correlation with the sample size, which means that the two variables move in the same direction together.“

The same phenomenon is also found when calculating sample size in Monetary Unit Sampling.

Could evaluate the sample size

Interestingly, you can not only decide on a sample size using expected misstatements but also evaluate the sample size after gathering results from the samples.

When the projected misstatement exceeds the expected misstatement, the sample may not be large enough to provide the planned risk of incorrect acceptance (that is, results in an inadequate allowance for sampling risk.) In other words, pursuant to paragraph .A27 of AU-C section 530, the auditor typically considers the risk (for instance, sampling risk) that there might be other, undetected misstatements remaining in the population examined that might indicate a material misstatement or an amount greater than tolerable misstatement exists.

Par 4.79

If your projected misstatement was more than the expected misstatement, your sample size was too small to cover the sampling risk of incorrectly accepting the financial statement while in fact, it contains material misstatement. So, you may add your sample as a response.

Unfortunately adding samples always means additional costs for both the auditor and the client. So, deciding the appropriate expected misstatement leads to a decent sample size which could enhance the audit’s efficiency.

Expected Misstatement in Monetary Unit Sampling

The previous part discusses one of the correlations between expected misstatement and monetary unit sampling, expected misstatement dictates the sample size. But there is another relationship between both.

The expected misstatement could maintain the audit risk in MUS. If you increase the expected misstatement, the sample size is automatically higher, and the greater the chance you will catch the misstatement (or prove that no material misstatement occurs), so reducing the audit risk.

Factors Influencing Expected Misstatement

Now, after knowing what is the expected misstatement, and the effects, how do we decide the “right” one? The answer, as always, is based on your professional judgment.

But after considering such factors as below.

- The entity’s business and risks. Each industry is unique and has its characteristics and risks which may be different from other industries.

- The results of the prior year’s test of the account balance. You may communicate with the predecessor auditor to gather information about possible misstatements and other critical information.

- The results of any pilot sample. A pilot sample provides preliminary insights into the nature, frequency, and monetary impact of misstatements within the population.

- The results of any tests of the related controls. Testing the related controls helps auditors assess whether the internal controls designed to prevent or detect misstatements are operating effectively. Effective controls reduce the likelihood of errors or fraud, thereby lowering the expected misstatement.

Conclusion

Expected misstatement plays a critical role in determining sample size, assessing audit risk, and audit efficiency. Determining the expected misstatement involves a comprehensive understanding of the entity’s business and associated risks. By considering factors such as industry characteristics, business model, economic environment, internal control effectiveness, and historical misstatements, you can accurately estimate expected misstatements. This estimation helps in designing effective and efficient audit procedures, ultimately reducing audit risk and enhancing the reliability of the audit findings.

For more insights and practical tips on improving your audit processes, subscribe to our newsletter and stay updated with the latest in auditing techniques and best practices.